Irc Section 179

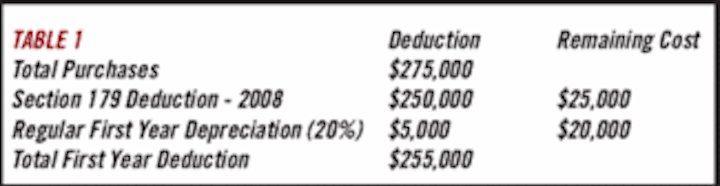

For tax years beginning after 2017 the tcja increased the maximum section 179 expense deduction from 500 000 to 1 million.

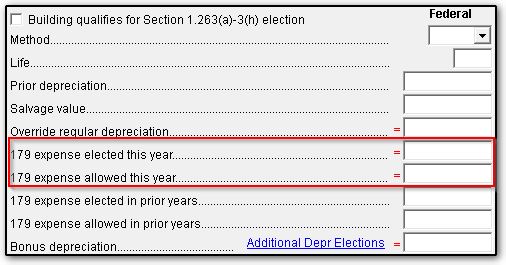

Irc section 179. This allows businesses to. Prior to amendment text read as follows. Any cost so treated shall be allowed as a deduction for the taxable year in which the section 179 property is placed in service.

Such term shall not include any property described in section 50 b and shall not include air conditioning or heating units. Section 179 deduction this deduction also called first year expensing is a write off for purchases in the year you buy and place the equipment in service i e it s operational for business use. 179 b limitations.

The property you deduct must also be purchased for business use and put into service in the year that you claim the deduction. 179 a treatment as expenses a taxpayer may elect to treat the cost of any section 179 property as an expense which is not chargeable to capital account. Essentially section 179 of the irs tax code allows businesses to deduct the full purchase price of qualifying equipment and or software purchased or financed during the tax year.

Section 179 of the irc allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment vehicles and software. That means that if you buy or lease a piece of qualifying equipment you can deduct the full purchase price from your gross income. For purposes of this section the term section 179 property means any tangible property to which section 168 applies which is section 1245 property as defined in section 1245 a 3 and which is acquired by purchase for use in the active conduct of a trade or business.

Section 179 of the united states internal revenue code 26 u s c. Section 179 refers to a section of the u s. 179 allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense rather than requiring the cost of the property to be capitalized and depreciated.