Section 332 Liquidation Statement

A corporation converted its wholly owned subsidiary to a disregarded entity via a check the box election.

Section 332 liquidation statement. A distribution otherwise constituting a distribution in complete liquidation within the meaning of this subsection shall not be considered as not constituting such a distribution merely because it does not constitute a distribution or liquidation within the meaning of the corporate law under which the distribution is made. For purposes of this section a distribution shall be considered to be in complete liquidation only if. Basically the subsidiary s basis for assets carries over to the parent corporation so that any deferred gain or loss at time of liquidation is recognized if the parent subsequently sells the liquidated subsidiary s former assets.

332 b provides for nonrecognition of gain or loss where the corporation receiving such property was on the date of adoption of the plan of liquidation and at all times thereafter until the receipt of the property the owner of stock meeting the requirements of sec. 332 b liquidations to which section applies. Consistent with this 10 section 368 a 1 d 354 b 1 b.

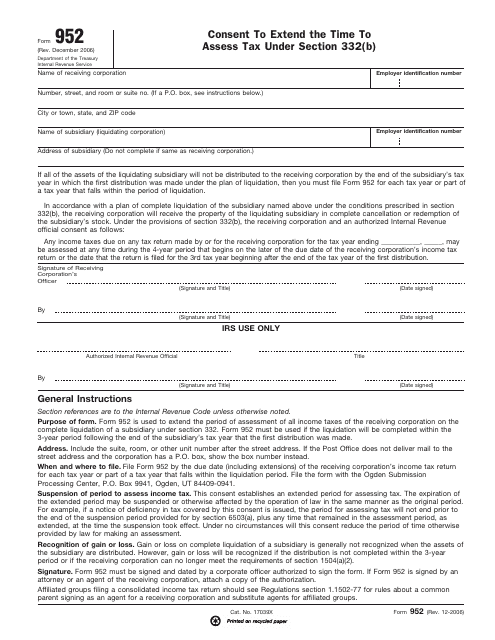

If any recipient corporation received a liquidating distribution from the liquidating corporation pursuant to a plan whether or not that recipient corporation has received or will receive other such distributions from the liquidating corporation in other tax years as part of the same plan during the current tax year such recipient corporation must include a statement entitled statement pursuant to section 332 by insert name and employer identification number if any of taxpayer a. Complete liquidations of subsidiaries. And for purposes of this subsection a transfer of property of such other corporation to the taxpayer shall not be considered as not constituting a distribution or one of.

For the liquidation to be a complete liquidation within the meaning of irc 332 the distribution must be made by a liquidating corporation in complete cancellation or redemption of all stock in accordance with a plan of liquidation or one of a series of distributions in complete cancellation or redem ption of all of its stock in accordance with a plan of liquidation. December 07 2014 chart of plr with outbound 332 liquidation last year we blogged about plr 201348011 where a u s. In the case of a liquidation under section 332 dealing with subsidiaries the recipient of liquidating distributions is required to submit with its return very detailed information even includ ing a list of all the properties received with their cost and fair market.

Section 332 liquidations section 332 provides that a parent corporation will not recognize gain or loss on the receipt of property distributed in complete liquidation of its controlled subsidiary and under section 334 will succeed to the subsidiary s basis in the distributed assets. 332 a general rule. 1504 a 2 generally 80 by voting power and value and the distribution was made in complete cancellation or redemption of all the stock of the liquidating corporation.

Section 332 liquidation of insolvent subsidiary via conversion to disregarded entity. The parent corporation sought a worthless stock loss under code 165 g 1. Corporation was not required to recognize gain on the distribution of its assets in liquidation to its foreign parent except with respect to gain attributable to intangibles described in code 936 h 3 b.