Leasehold Improvements Section 179

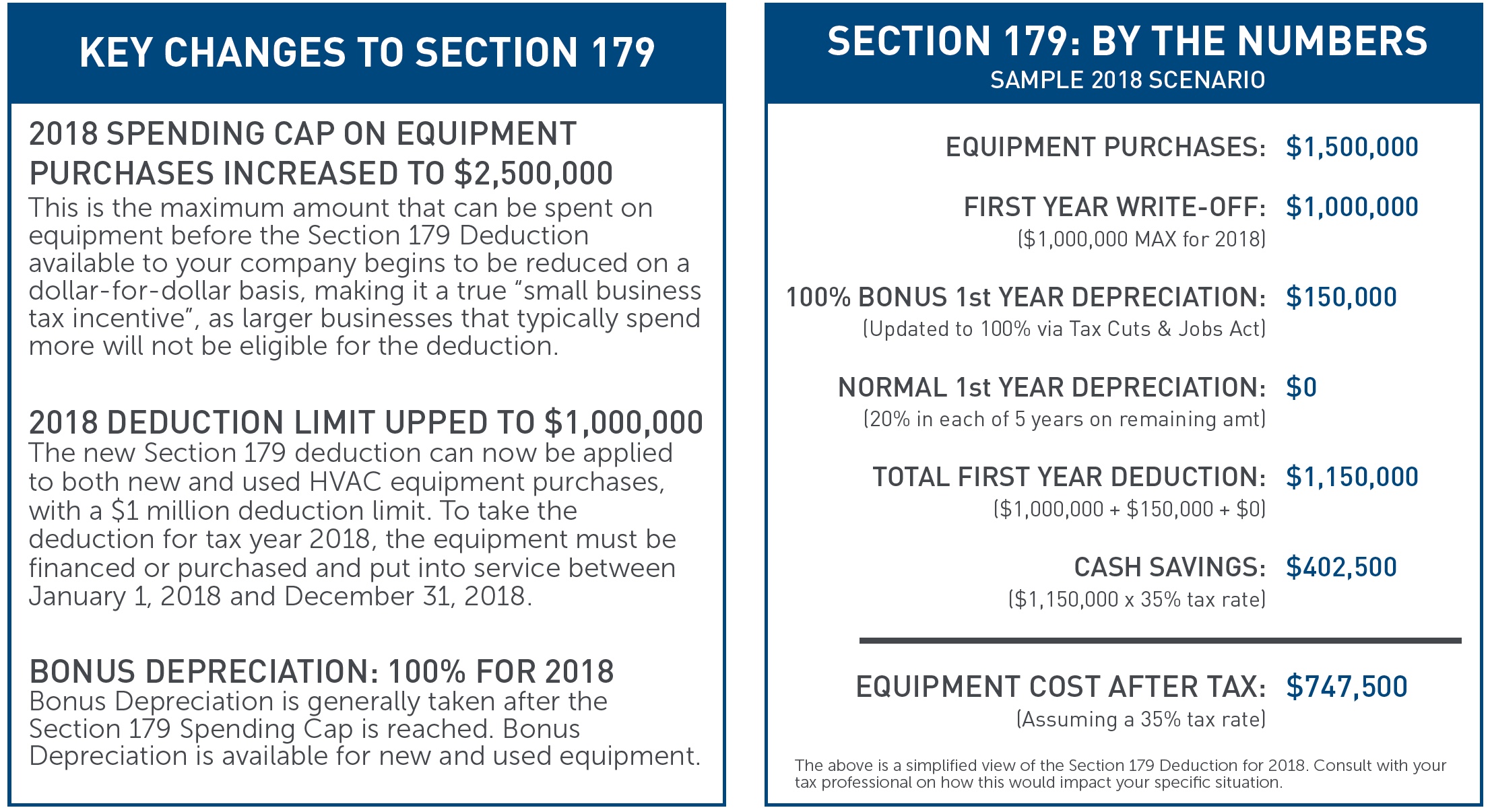

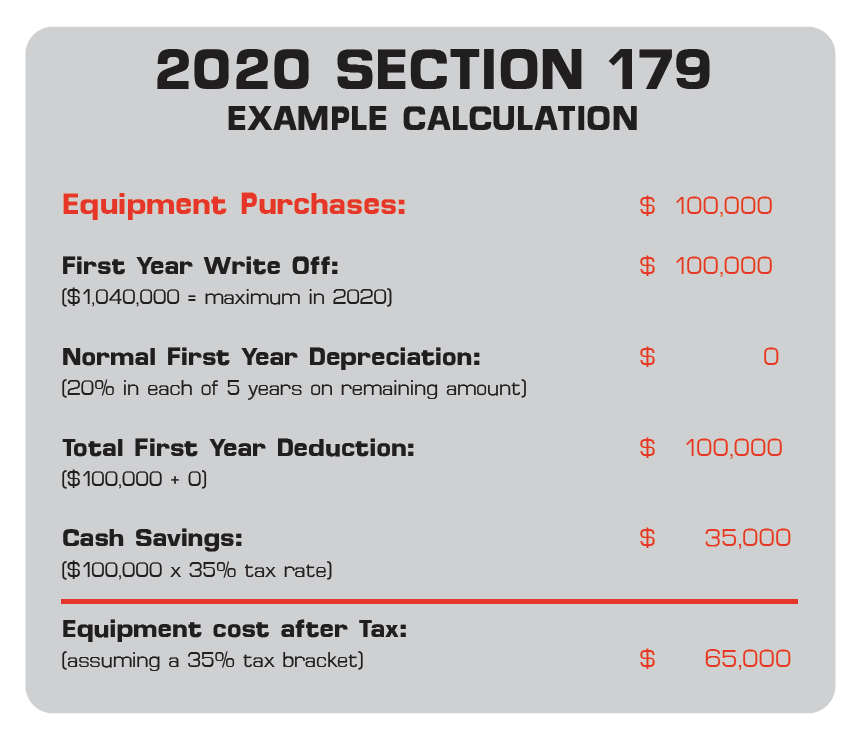

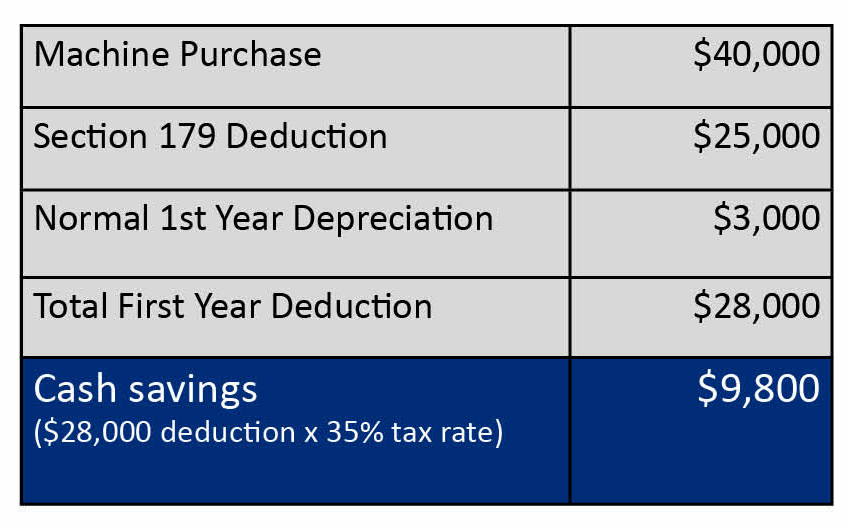

Fs 2018 9 april 2018 businesses can immediately expense more under the new law a taxpayer may elect to expense the cost of any section 179 property and deduct it in the year the property is placed in service.

Leasehold improvements section 179. One of the major changes to section 179 expensing is the ability to fully deduct qualified leasehold improvements. The new roof will be capitalized on your depreciation schedule and expensed under section 179 provision and the old roof is removed. 179 deduction phaseout threshold has also been increased to 2 5 million up from 2 03 million for tax years beginning in 2017.

Section 179 expensing phases out based on asset additions over 2 5 million up from the pre act 2 03 million. It also increased the phase out threshold from 2 million to 2 5 million. Landlords may agree with these improvements for existing or new tenants.

What if you spent 750 000 on leasehold improvements this year for one of your retail strip plazas. You can generally expense qualified improvements under section 179 as opposed to depreciating them. The new law increased the maximum deduction from 500 000 to 1 million.

Even if the requirements explained earlier under what property qualifies are met you cannot elect the section 179 deduction for the following property. Land and land improvements do not qualify as section 179 property. Land improvements include swimming pools paved parking areas wharves docks bridges and fences.

However section 179 begins to phase out when you place in service assets valued in excess of 2 000 000 in a single tax year. Qualified leasehold improvements can be expensed up to 250 000 for tax years beginning in 2010 and 2011. You can generally expense qualified leasehold improvements up to 500 000 adjusted annually for inflation under section 179 as opposed to depreciating them.

The act increased the expensing limit to 1 million up from 510 000. A leasehold improvement is a change made to a rental property to customize it for the particular needs of a tenant. The limit for 2016 is 500 000 and will be adjusted for inflation going forward.