Section 179 Recapture

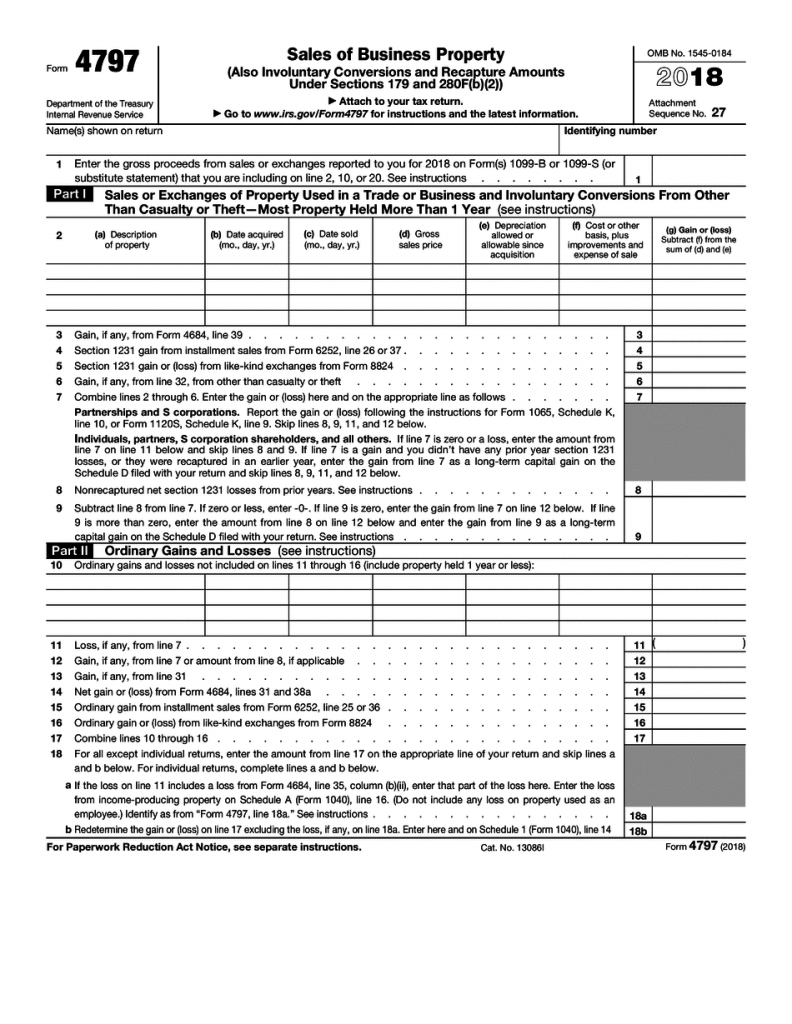

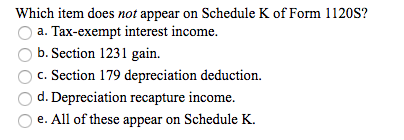

179 expense the amount of recalculated depreciation and the recapture amount.

Section 179 recapture. What is a section 179 recapture. 179 recapture due to decline in business use to 50 or less. Under internal revenue code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the cost up to a dollar limit by deducting the cost in the year you place the computer in service.

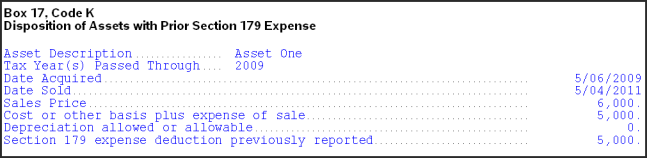

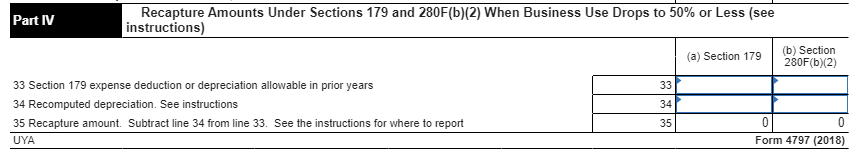

Any section 179 or 280f b 2 recapture amount included in gross income in a prior tax year because the business use of the property decreased to 50 or less. If the corporation passed through a section 179 expense deduction for the property the shareholder must report the gain or loss and any recapture of the section 179 expense deduction for the property on their income tax return. Specifically it should contain the year the asset was placed in service the amount of sec.

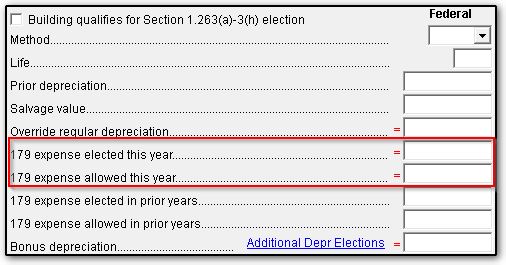

This occurs when a property that was section 179 expensed was used for mostly personal reasons after being placed in service. The schedule should contain information for each asset subject to sec. When that happens the depreciation you previously took is retroactively re calcuated using straight line depreciation and without section 179.

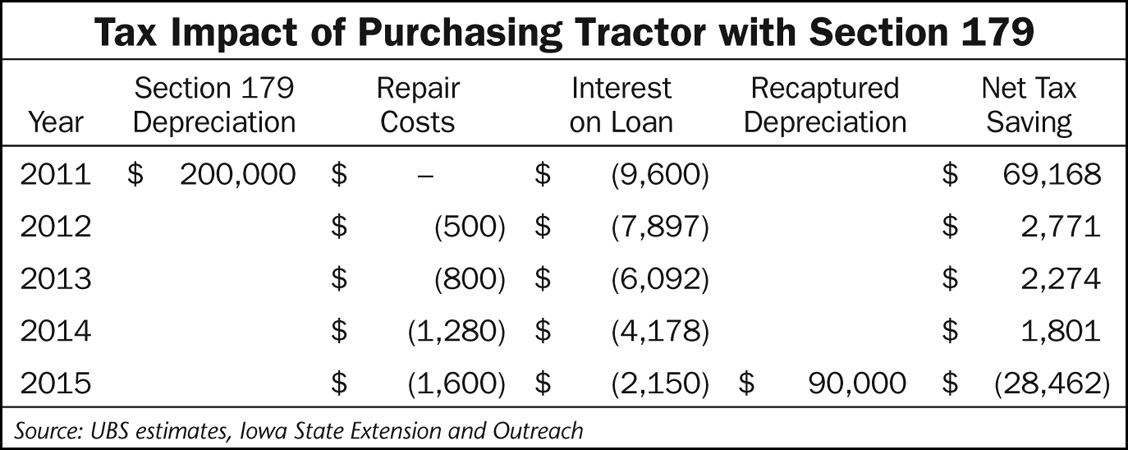

Section 179 recapture recapture also applies to section 179 assets and happens when a business adds income to a section 179 deduction taken in the prior year. A section 179 recapture occurs when you add income back to the section 179 deduction you took in a previous year. You may have to recapture the section 179 deduction if in any year during the property s recovery period the percentage of business use drops to 50 or less.

You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. In the year the business use drops to 50 or less you include the recapture amount as ordinary income in part iv of form 4797. Solved by turbotax 363 updated 1 week ago to meet the conditions of the section 179 deduction you must continue to use the asset more than 50 in your business until the asset has reached the end of its useful life.

You ll be able to read the full article and get instant access to the last few issues of the tax reduction letter. Don t let section 179 recapture hurt you.