Section 382 Limitation

The section 382 limitation as so determined is adjusted as required by section 382 and the regulations thereunder.

Section 382 limitation. Under section 382 of the irc a c corporation is required to have a limit to offset historic losses. Congress enacted section 382 to prevent a corporation with a large taxable income from purchasing a company with net operating losses nol carryforwards and using those acquired nols to offset income. One such limitation is imposed by section 382 of the tax code.

For loss corporations calculating the limitations of section 382 seems relatively simple at first but over the years this analysis has become somewhat complicated as a recent chief counsel advice demonstrates. The section 382 limitation is determined by multiplying the value of the loss corporation s equity before the ownership change by a specified rate that is determined each month by treasury and the irs. Industries aerospace defense.

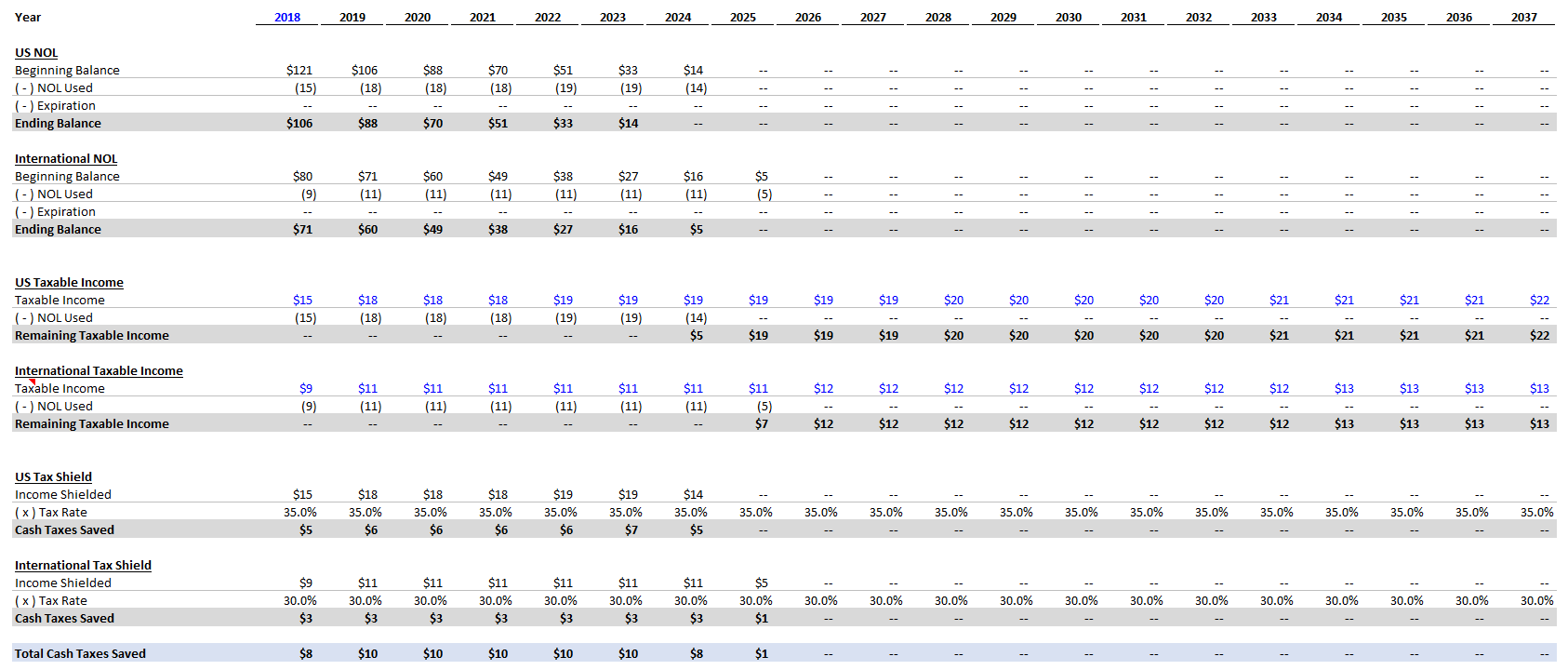

A loss corporation is a firm that can use tax attributes such as net operating loss nol to deduct their taxable income. 382 b 3 b i. As noted above section 382 together with section 383 establishes a limitation on the ability of carryforwards to be used by a loss corporation after an ownership change section 382 limitation.

If the section 382 limitation for any post change year exceeds the taxable income of the new loss corporation for such year which was offset by pre change losses the section 382 limitation for the next post change year shall be increased by the amount of such excess. In this article we provide an overview of the section 382 limitation and valuation considerations concerning the calculation of the section 382 limitation. Once an ownership change is determined the section 382 limitation must be calculated to accurately determine the amount of nols that are available to offset future taxable income.

When is section 382 applicable. The section 382 limitation for any post change year that is less than 365 days is the amount that bears the same ratio to the section 382 limitation determined under section 382 b 1 as the number of days in the post change year bears to 365. For purposes of applying the limitation of subsection a to the remainder of the taxable income for such year the section 382 limitation shall be an amount which bears the same ratio to such limitation determined without regard to this paragraph as i r c.

Section 382 limits the availability of net operating losses and tax credits when a company has a change in ownership which has a broader definition than many companies expect.