Section 179 F

Yes you can claim section 179.

Section 179 f. Section 179 of the u s. Section 179 refers to a section of the u s. Section 179 deductions allow taxpayers to deduct the cost of specific properties as expenses when those properties are used as a service.

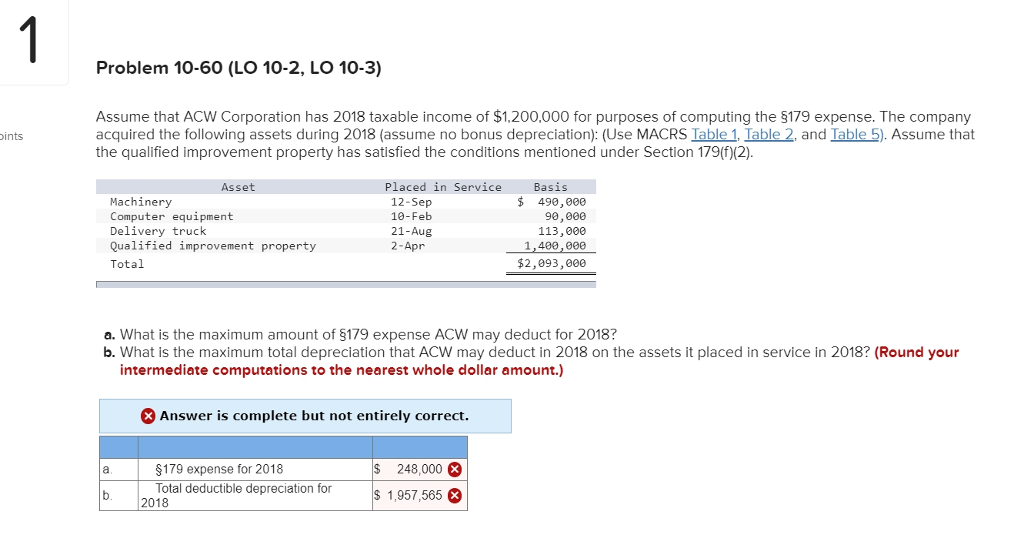

For purposes of this section the term section 179 property means any tangible property to which section 168 applies which is section 1245 property as defined in section 1245 a 3 and which is acquired by purchase for use in the active conduct of a trade or business. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment instead of capitalizing and. Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service.

Such term shall not include any property described in section 50 b and shall not include air conditioning or heating units. If the business is a partnership or corporation you can not use a loss with section 179. Tax code allowing for businesses to deduct property cost when eligible.

The phase out limit increased from 2 million to 2 5 million. Internal revenue code section 179 f election to expense certain depreciable business assets. It s very likely that your business will purchase many of these goods during the year and will do so again and again.

Section 179 was designed with businesses in mind. If you claim section 179 it will be carried to the next year. Section 179 f determination of eligibility for payment of interest on amounts owed to contractors.

All businesses need equipment on an ongoing basis be it machinery computers software office furniture vehicles or other tangible goods. That means that if you buy or lease a piece of qualifying equipment you can deduct the full purchase price from your gross income. If a taxpayer elects the application of this subsection for any taxable year the term section 179 property shall include any qualified real property which is a of a character subject to an allowance for depreciation b acquired by purchase for use in the active conduct of a trade or business and c not described in the.

:max_bytes(150000):strip_icc()/cropped-image-of-insurance-agent-discussing-with-client-at-desk-1036263996-4039318a6c5b4039b9e198a1d7cb549e.jpg)