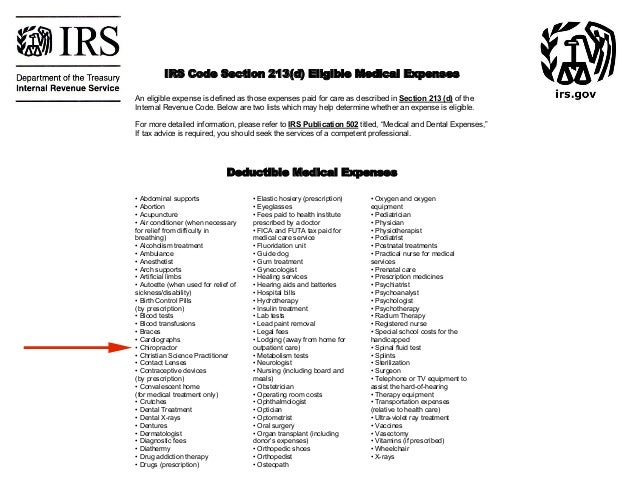

Irs Code Section 213 D

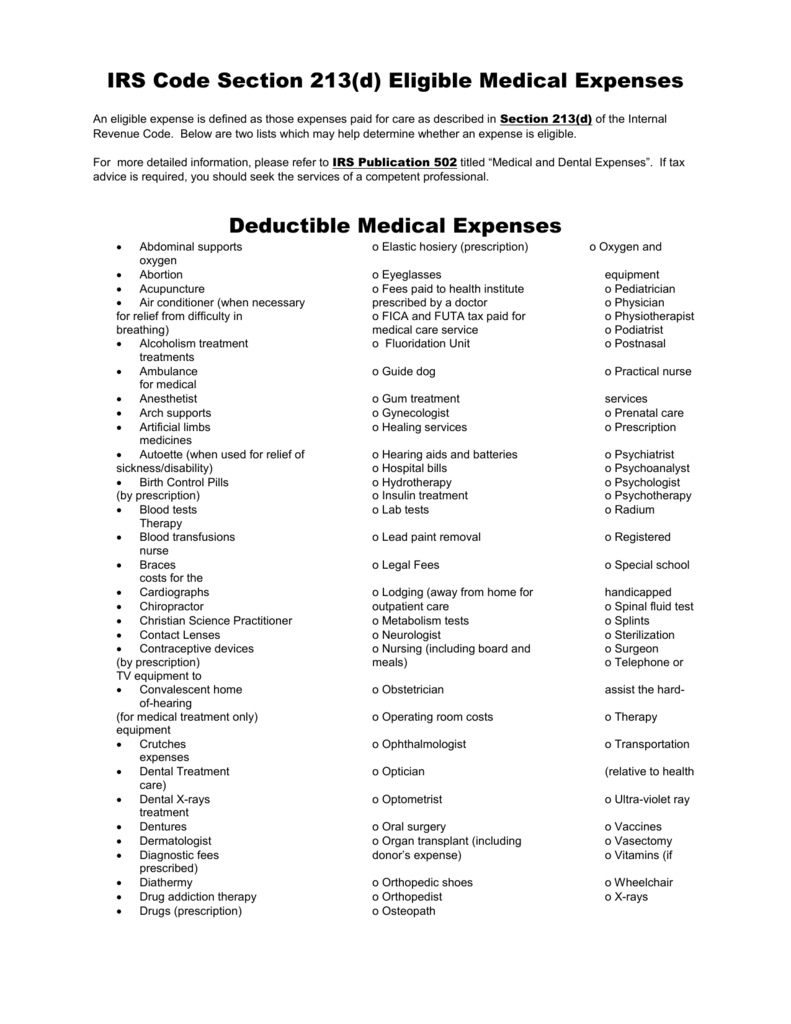

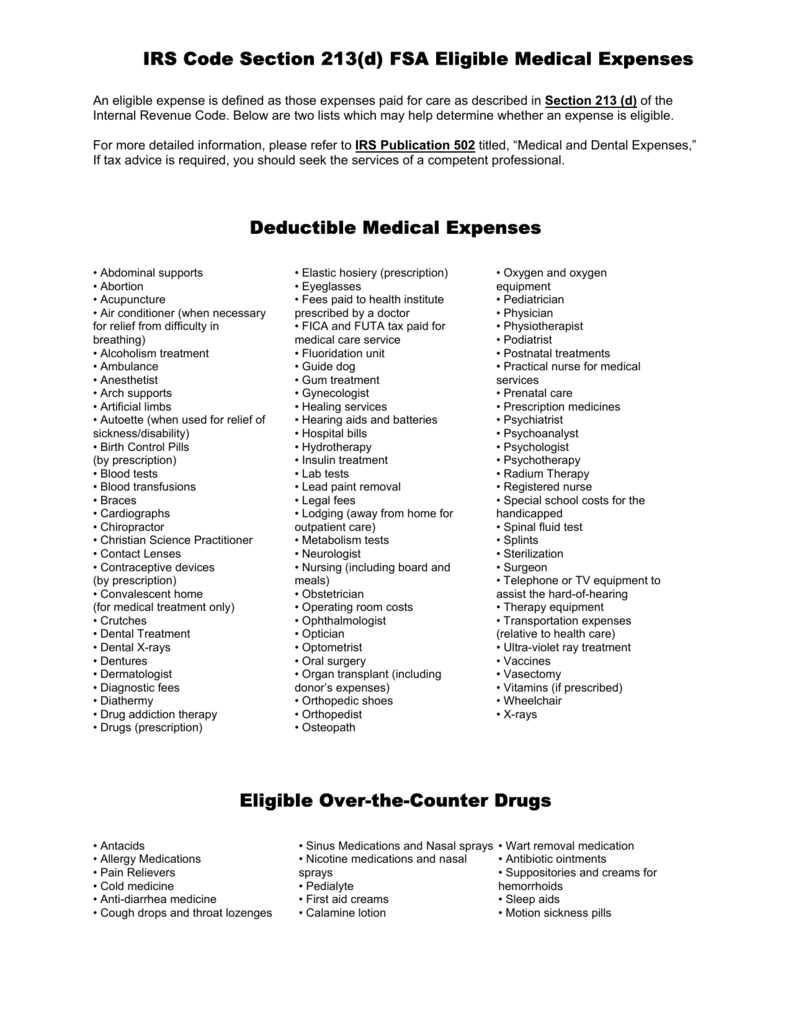

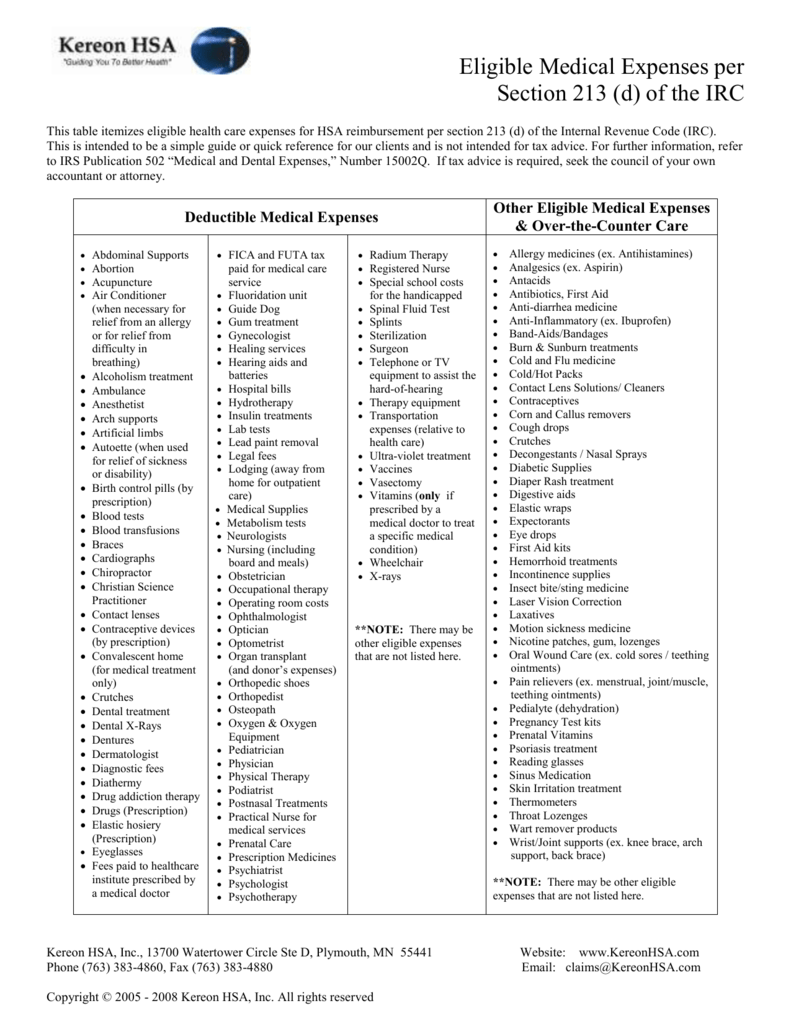

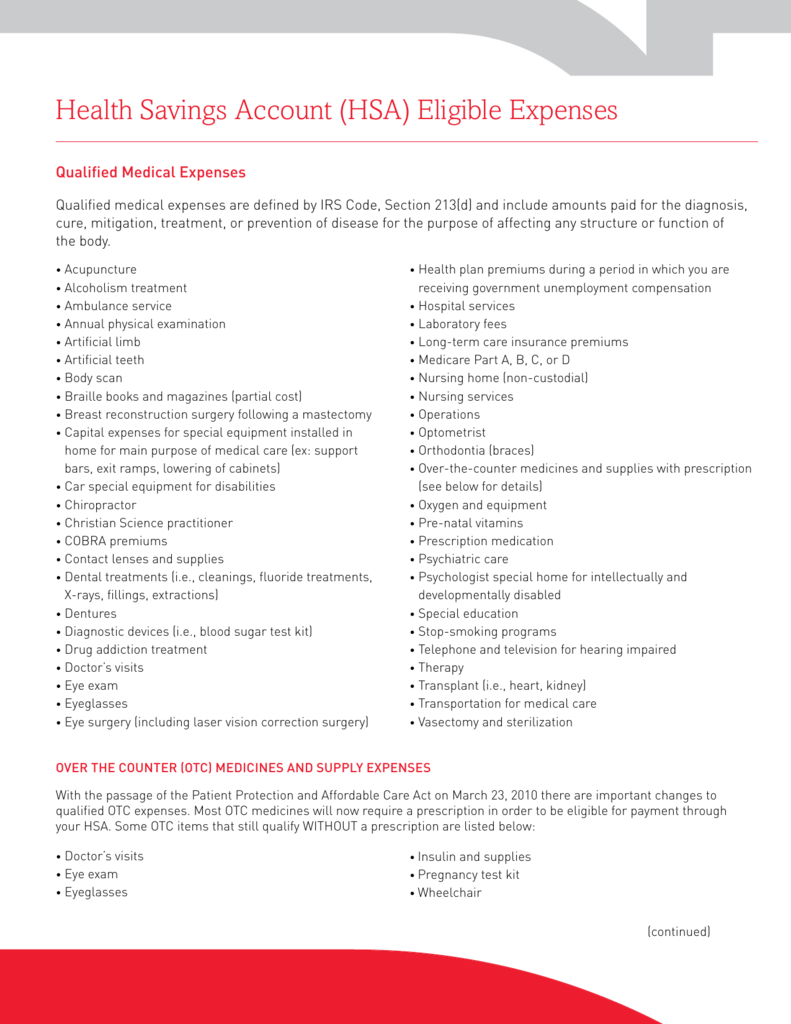

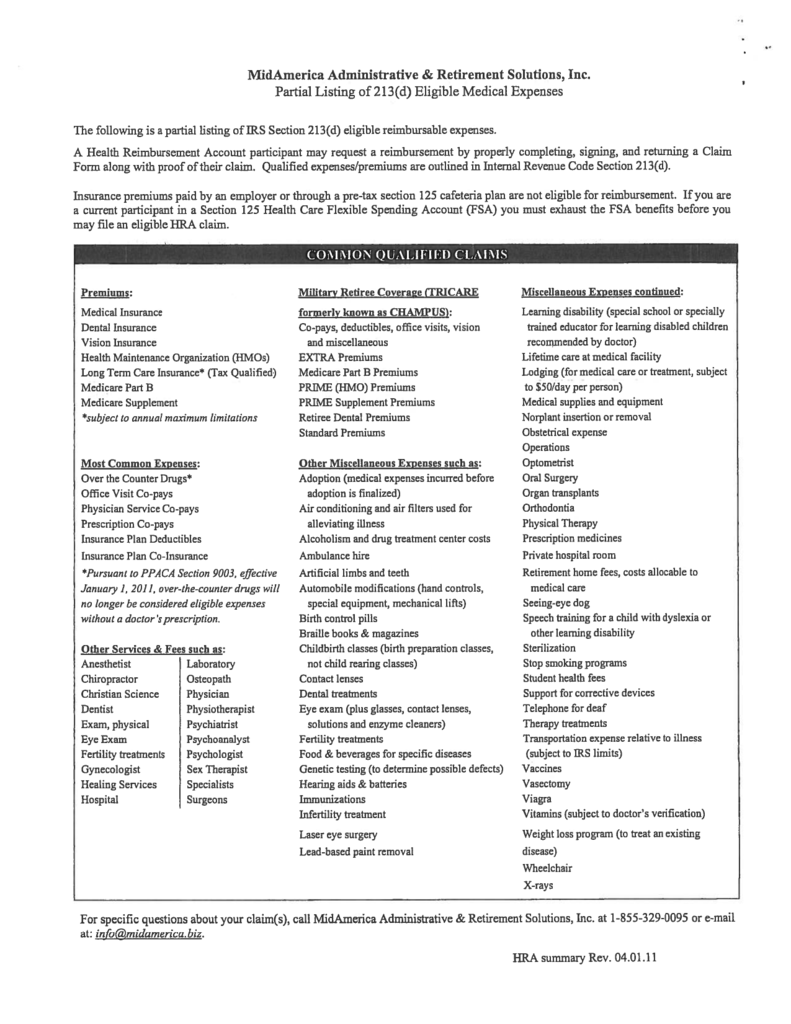

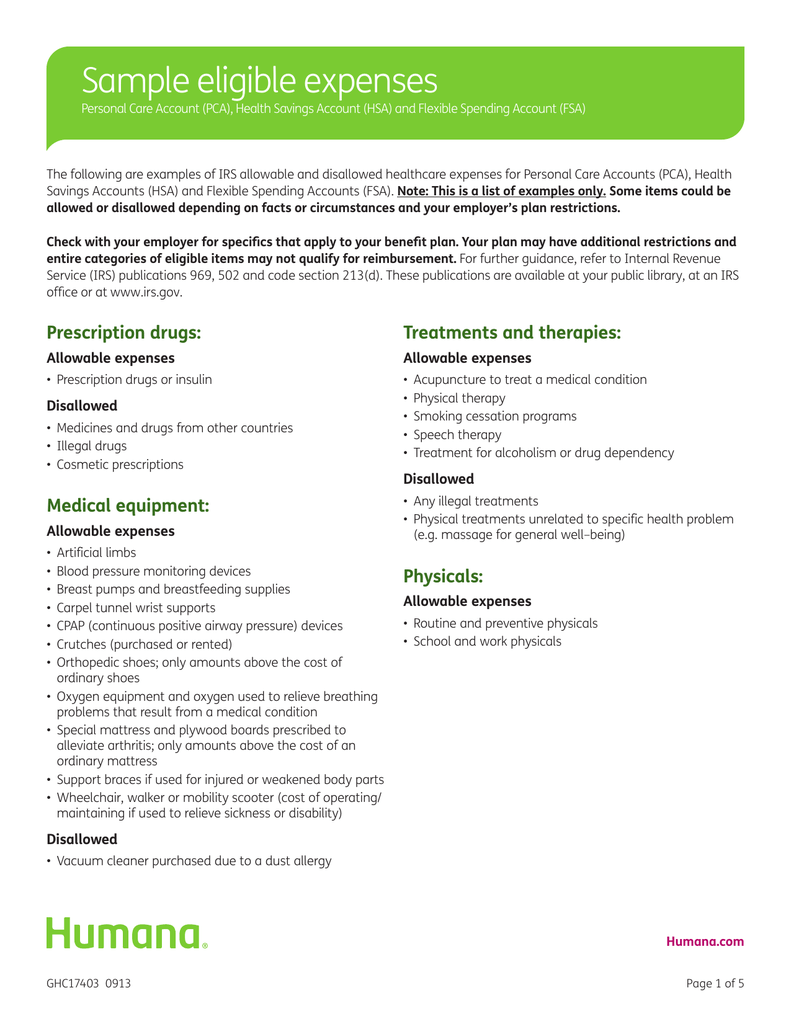

Below are two lists which may help determine whether an expense is eligible.

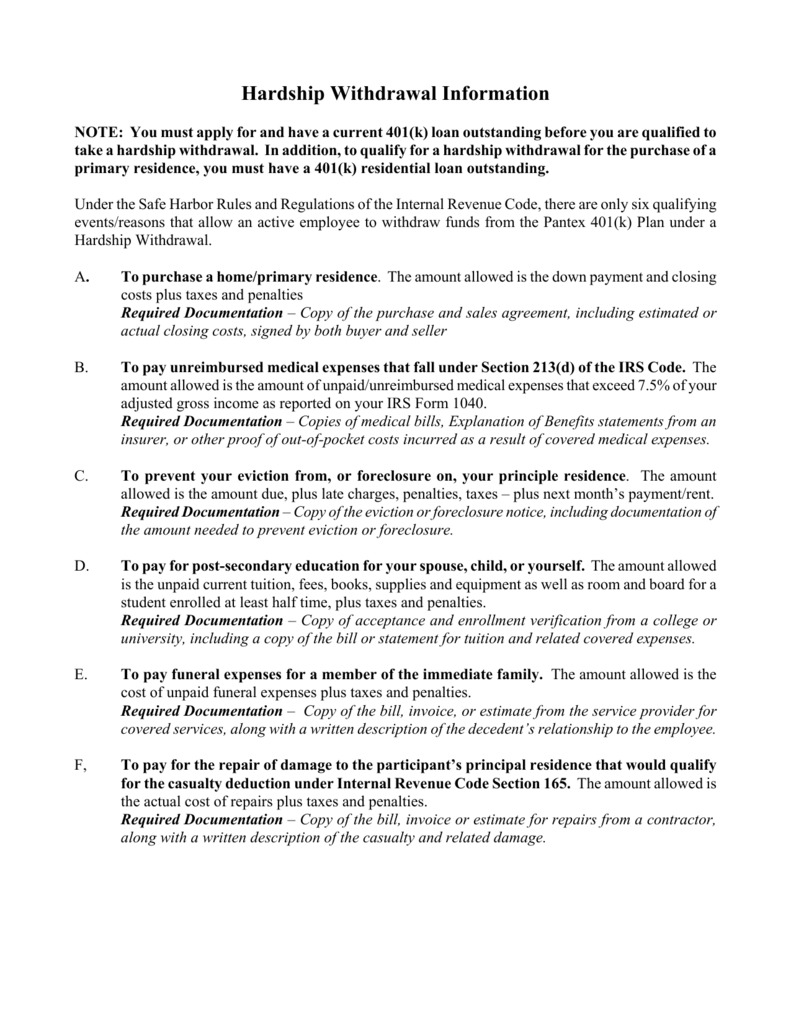

Irs code section 213 d. Nw ir 6526 washington dc 20224. In addition to participating in the promulgation of treasury tax regulations the irs publishes a regular series of other forms of official tax guidance including revenue rulings revenue procedures notices and announcements see understanding irs guidance a brief primer for more information about official irs guidance versus non precedential rulings or advice. Irs code section 213 d eligible medical expenses an eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code.

101 508 set out as a note under section 32 of this title. 31 1990 see section 11111 f of pub. 101 508 applicable to taxable years beginning after dec.

Amendment by section 11111 d 1 of pub. We welcome your comments about this publication and your suggestions for future editions. Internal revenue service tax forms and publications 1111 constitution ave.

For more detailed information please refer to irs publication 502. You can send us comments through irs gov formcomments or you can write to. Irs code section 213 d eligible medical expenses an eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code.

Below are two lists which may help determine whether an expense is eligible.