Section 213 D Of The Internal Revenue Code

Nw ir 6526 washington dc 20224.

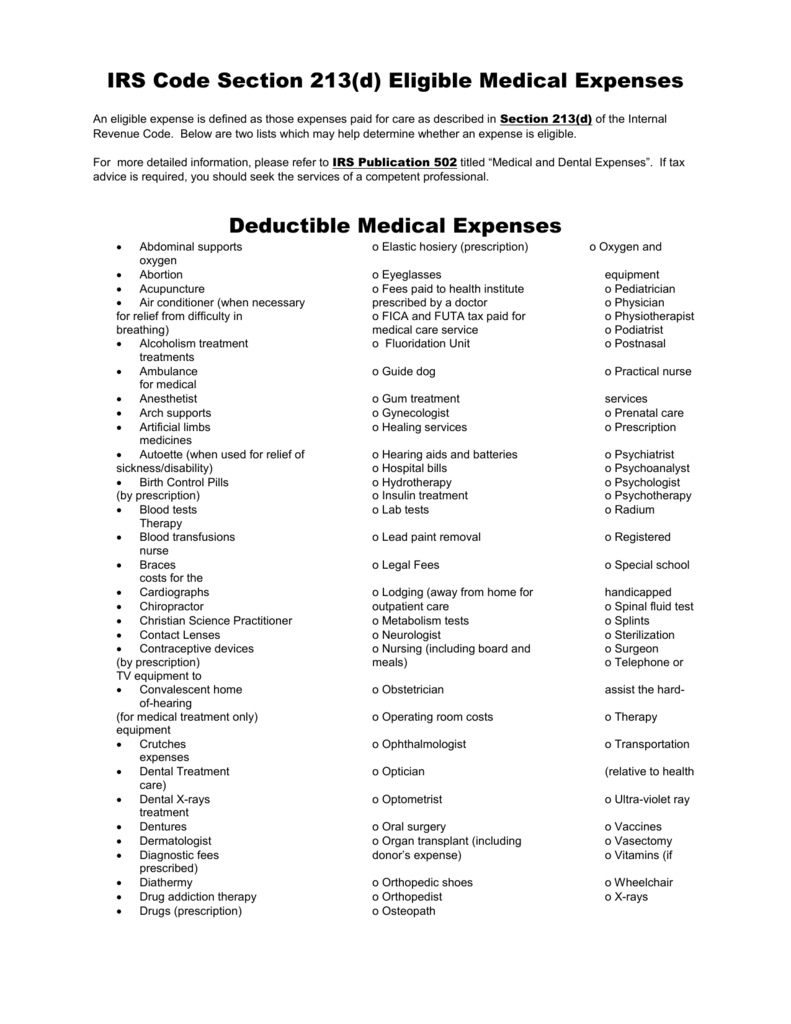

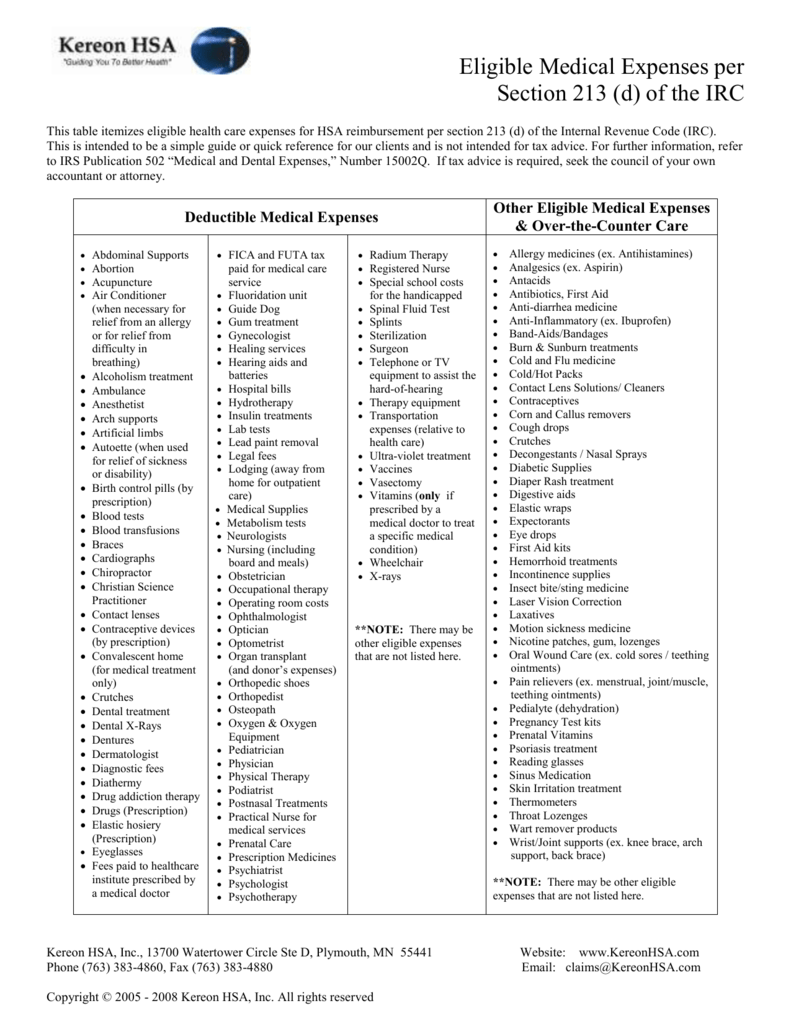

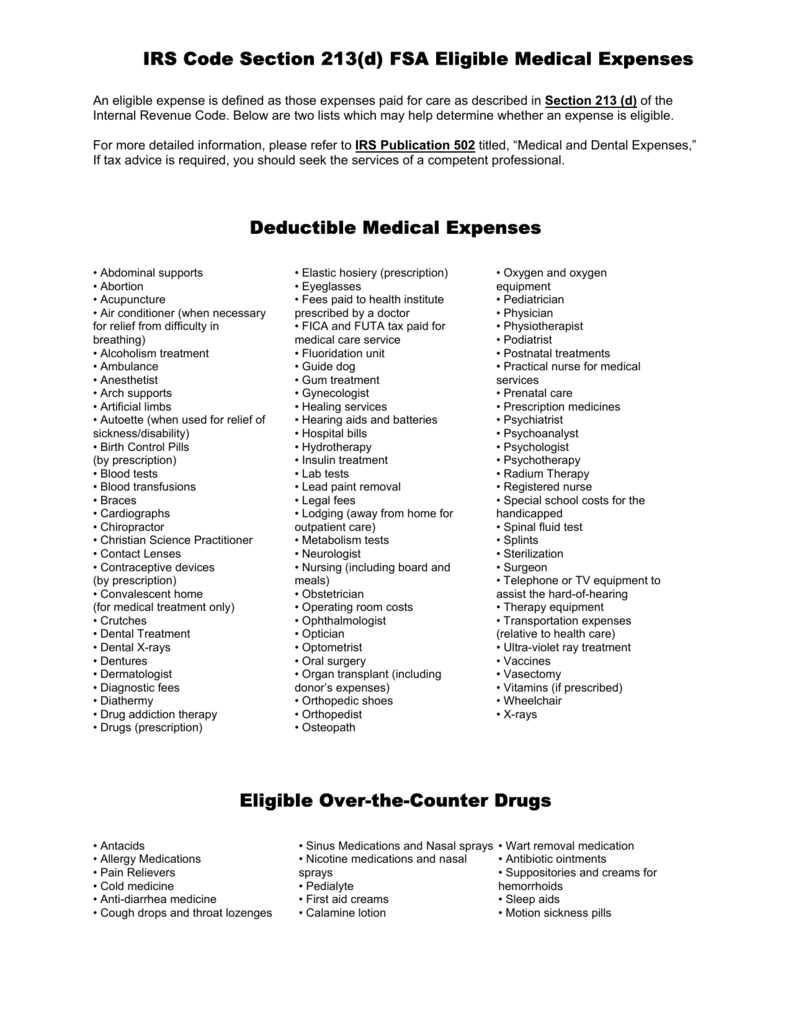

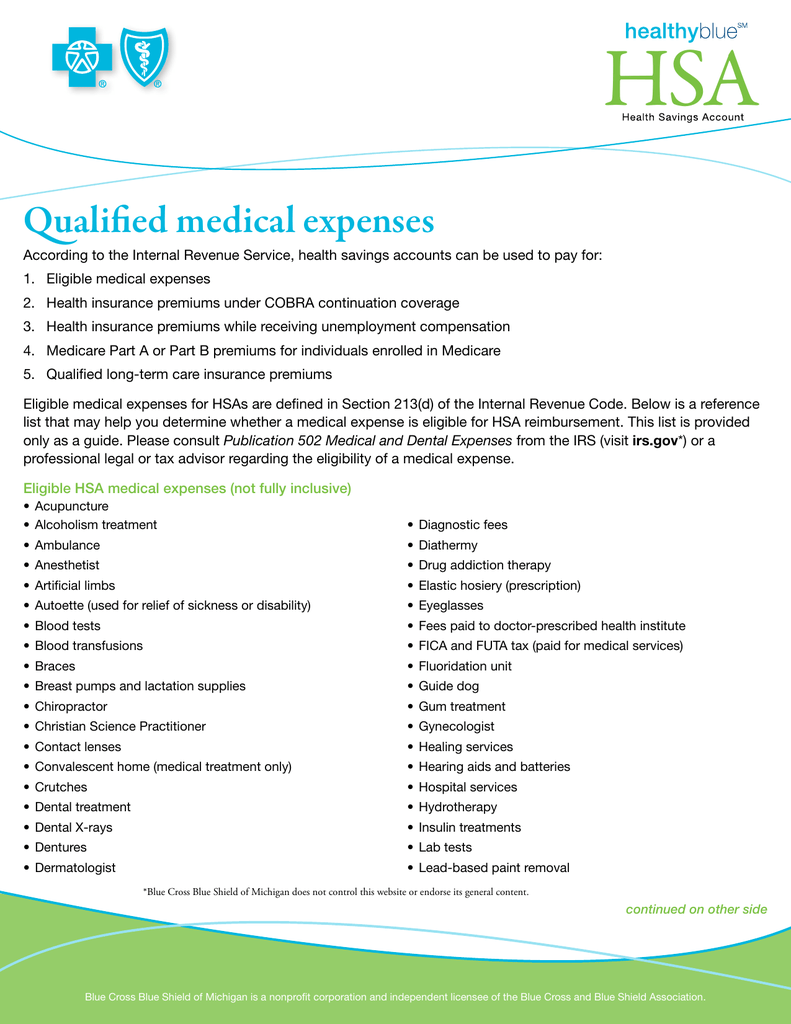

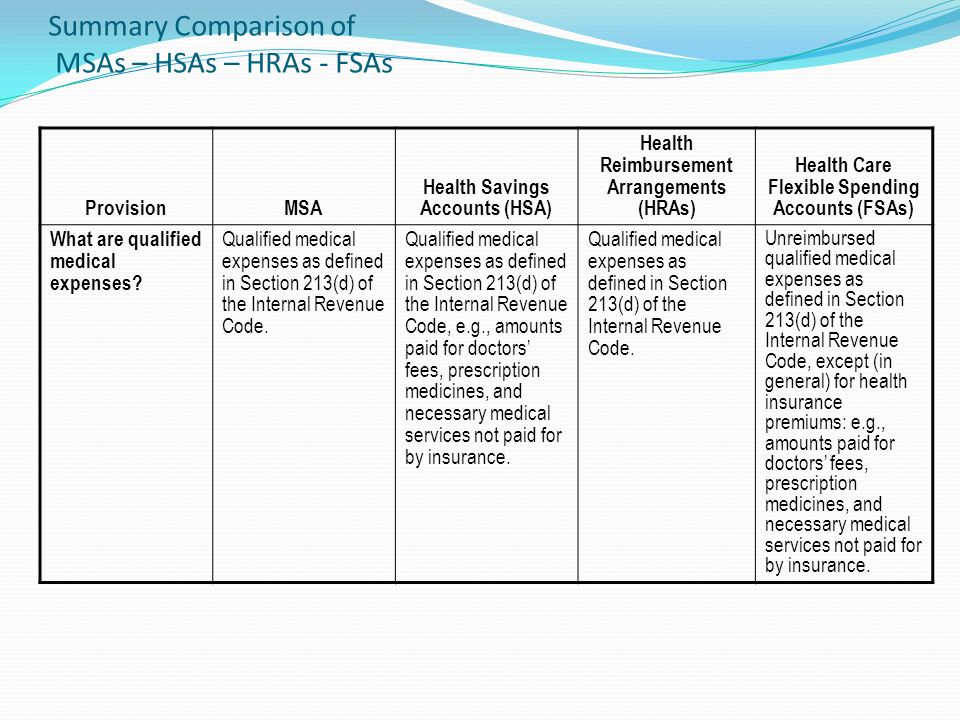

Section 213 d of the internal revenue code. Below are two lists which may help determine whether an expense is eligible. Below are two lists which may help determine whether an expense is eligible. Irs code section 213 d fsa eligible medical expenses.

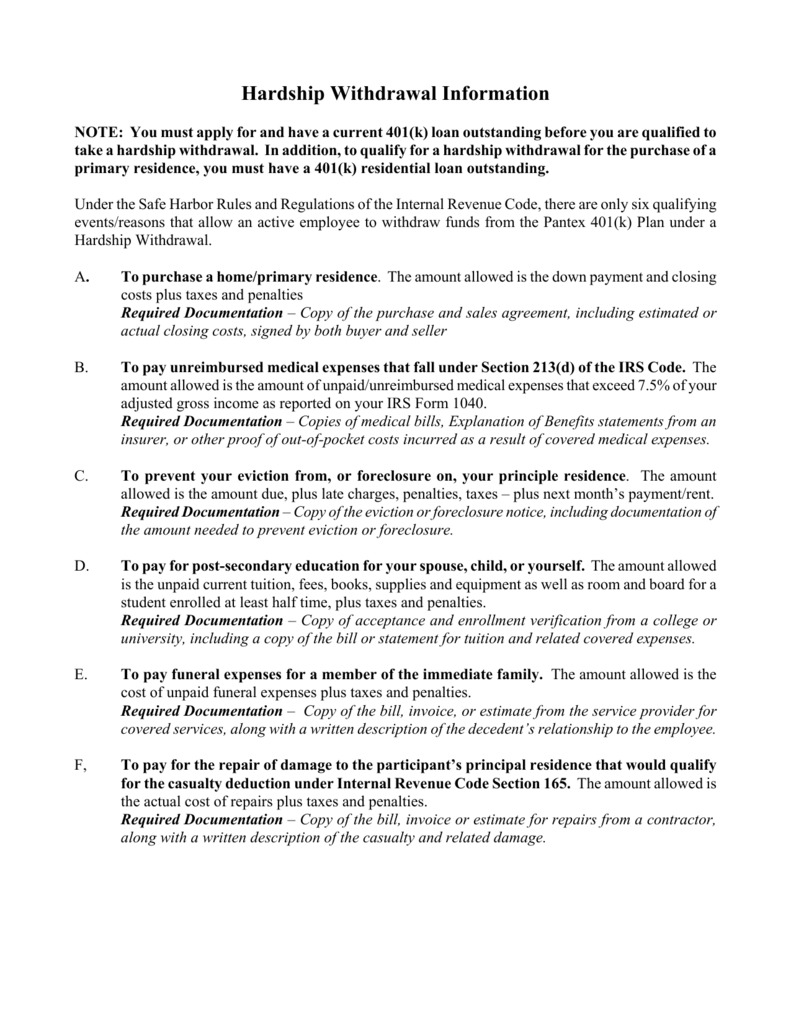

213 d 5 special rule in the case of child of divorced parents etc. There shall be allowed as a deduction the expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer his spouse or a dependent as defined in section 152 determined without regard to subsections b 1 b 2 and d 1 b thereof to the extent that such expenses exceed 10 percent of adjusted gross income. An eligible expense is defined as those expenses paid for care as described in.

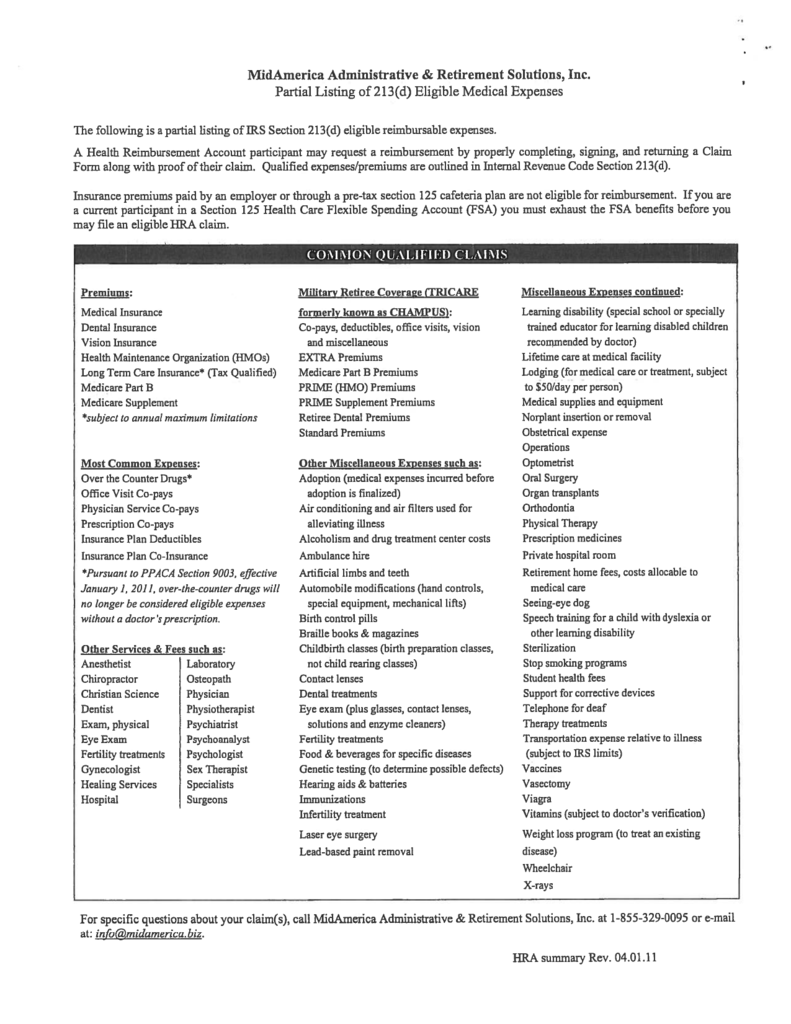

Irs code section 213 d eligible medical expenses. Section 213 d of the internal revenue code. 213 d 6.

For more detailed information please refer to irs publication 502titled medical and dental expenses if tax advice is required you should seek the services of a competent professional. Although we can t respond individually to each comment received we do appreciate your feedback and will consider your comments as we revise our tax forms instructions and publications. Table of contents retrieve by section number.

Section 213 of the internal revenue code irc allows a deduction for expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer spouse or dependent to the extent the expenses exceed 7 5 of adjusted gross income. Internal revenue service tax forms and publications 1111 constitution ave. Under section 213 d medical care includes amounts paid for the diagnosis cure mitigation treatment or prevention of disease or for the purpose of affecting any structure or function of the body.

An eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code. For more detailed information please refer to irs publication 502 titled medical and dental expenses if tax advice is required you should seek the services of a competent professional. Irs code section 213 d eligible medical expenses.