Section 179 Deduction Vehicle List

For example vehicles purchased and put into service between january 1 and december 31 2020 can qualify for a 2020 section 179 deduction.

Section 179 deduction vehicle list. However the section 179 deduction is limited to 25 000 for trucks and suvs. This deduction also called first year expensing is a write off for purchases in the year you buy and place the equipment in service i e it s operational for business. Guidelines concerning vehicles that weight more than 6 000lbs.

Simply multiply the cost of the equipment vehicle s and or software by the percentage of business use to arrive at the monetary amount eligible for section 179. Since a vehicle that weighs over 6 000 pounds can certainly be considered a business asset it is reasonable to expect a section 179 allowance to exist for it. As promised below is our annual guide to tax code section 179 for self employed and business owners who buy a vehicle.

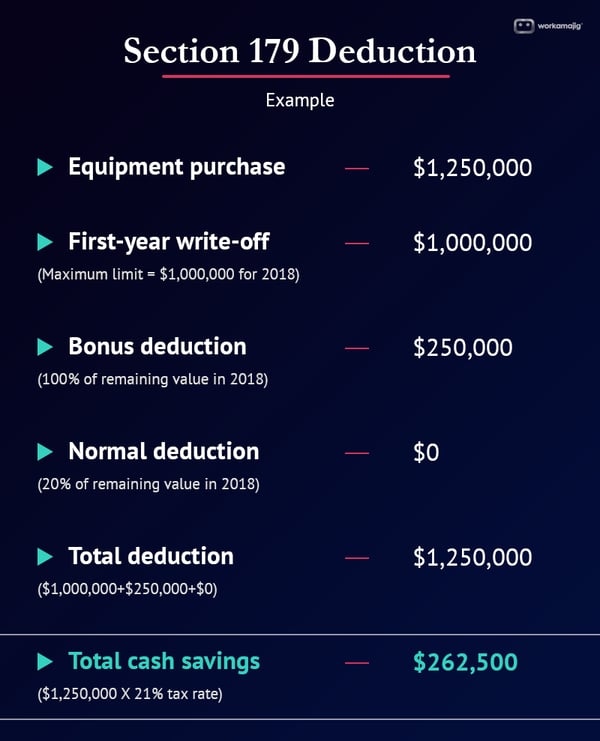

If so you must reduce the maximum 1 million deduction by every dollar that goes above your 2 5 taxable limit. It s easier to list the typical vehicles that will generally qualify for a full section 179 deduction and then discuss the rules for other vehicles. The advantage of the deduction is you immediately receive the tax savings from an equipment purchase rather than gradually saving taxes through depreciation in future years.

Many work vehicles that by their nature are not likely to be used for personal purposes will usually always qualify for full section 179 deduction. Another method of deducting the cost of a heavy vehicle is using section 179. Tax code 179 tax code 179 the special deduction to write off equipment in the year purchased was extended permanently in 2015 legislation.

Here is a list of vehicles with a gross loaded weight of over 6 000 lbs that qualify for the section 179 deduction. The equipment vehicle s and or software must be used for business purposes more than 50 of the time to qualify for the section 179 deduction. We have tried to make the list as exhaustive as possible.

Section 179 allows business owners to deduct 1 million in personal property they buy for their business each year. Additionally the vehicle must be purchased and put in use between january 1 and december 31 of the same year in order to for the section 179 deduction. This guide encompasses qualifying vehicles purchased in the 2019 calendar year.