Section 12c Of The Income Tax Act

1 any voluntary contributions received by a trust created wholly for charitable or religious purposes or by an institution established wholly for such purposes not being contributions made with a specific direction that they shall form part of the corpus.

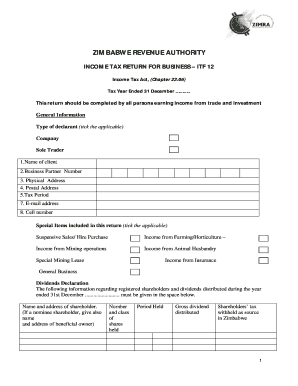

Section 12c of the income tax act. Section 12 of income tax act income of trusts or institutions from contributions 12. 1961 income tax department all acts income tax act 1961. New unused plant and machinery directly involved in process of manufacture.

11 of act 90 of 1988 12c. Apportionment of income between spouses governed by portuguese civil code. 14 1 of act 101 of.

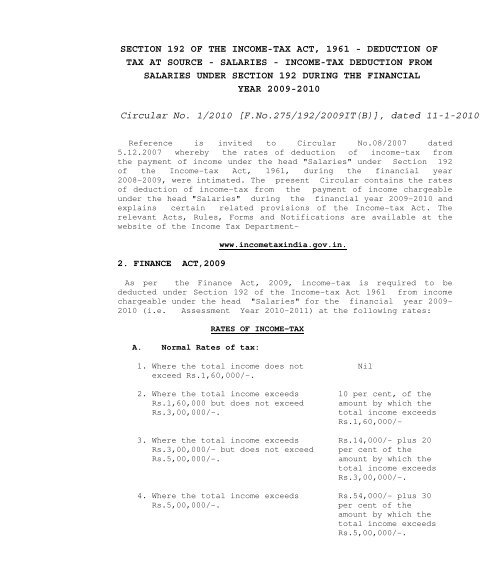

Scope of total income. Reference to taxation year 2 where an individual s income for a. Section 12c again provides for a tax allowance in respect of assets used for manufacturing co operatives hotels ships and aircraft.

Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. The income tax department never asks for your pin numbers. 12c wear tear allowance iro machinery plant new or used used directly in manufacturing process brought into use for the first time by the taxpayer for purposes of his trade allowance based on cost of asset.

Costs for purposes of section 8 1 of the income tax act 58 of 1962 fixing of rate per kilometre in respect of motor vehicles for the purposes of section 8 b ii. Proprietor of business 11 1 subject to section 34 1 if an individual is a proprietor of a business the individual s income from the business for a taxation year is deemed to be the individual s income from the business for the fiscal periods of the business that end in the year. 12c inserted by s.

Section 12c 4a has been introduced into the act to provide that when a qualifying asset was during any previous year brought into use for the first time by the taxpayer for the purposes of a trade carried on by him the receipts and accruals of which were not included in his income during that year any deduction that could have been allowed will for the purposes of section 12c be deemed to have been allowed as if the receipts and accruals of the trade had been included in his income. If you are a small business corporation please use our sbc calculator instead. Income tax act act income tax act subsidiary legislation legislation is reproduced on this website with the permission of the government of singapore.