Section 125 Qualifying Event

Under section 125 of the internal revenue code if you do decide to cancel without a qle then you and your employer would incur tax.

Section 125 qualifying event. Additionally section 125 is the irs code that regulates permissible mid year qualifying events. Part 1 under section 125. Section 125 qualifying event.

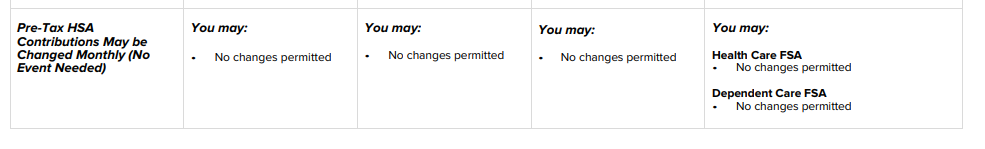

Section 125 qualifying events 2 event description examples coverage affected change in cost 2 a change in the cost of coverage that permits the employer to automatically increase or decrease the employee contributions. Hipaa requires group health plans to give special enrollment opportunities to certain employees dependents and cobra qualified beneficiaries. An organization s section 125 plan allows an employee to make tax free deductions for group health plans as well as tax free contributions into a flexible spending account fsa.

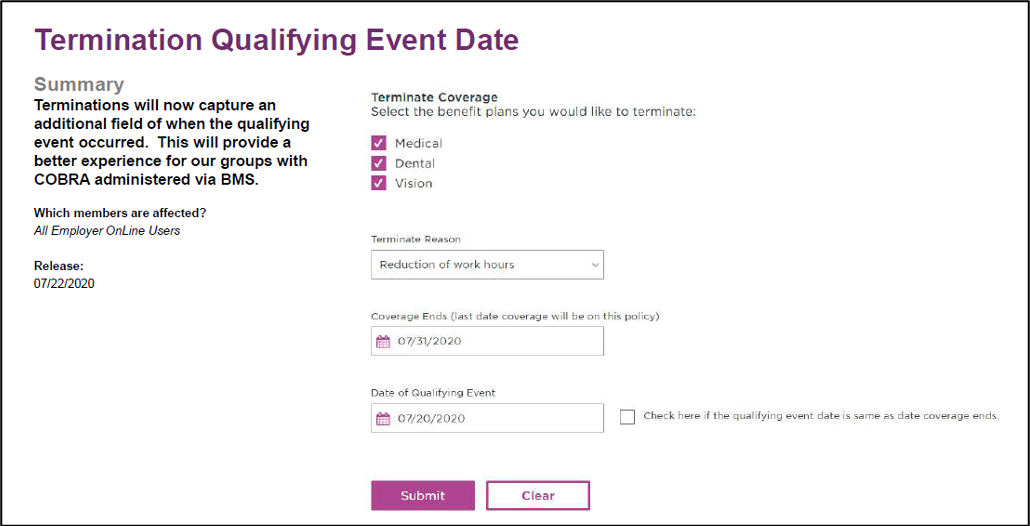

You must request changes within 30 days of the qualifying event or wait until the next annual open. While allowing a mid year election change is a matter of plan design the plan can only allow a mid year election change as permitted by the irs. For a mid year election change to be allowed the cafeteria plan must permit it in the written section 125 plan document.

The total dependent care benefits the employer paid to the employee or incurred on the employee s behalf including amounts from a section 125 plan should be reported in box 10 of form w 2. Qualifying events the irs section 125 only allows changes to your group insurance elections during the plan year when an eligible change in status occurs which affects your your spouse s and or your dependent s coverage eligibility. Those permitted election change events include.

26 cfr 1 125 4 b a special enrollee is allowed to enroll or change his or her. If you want to cancel an employer plan outside of the company s open enrollment it would require a qualifying life event. A dependent means a dependent as defined in section 152 except that for purposes of accident or health coverage any child to whom section 152 e applies is treated as a dependent of both parents and for purposes of dependent care assistance provided through a cafeteria plan a dependent means a qualifying individual as defined in section.

Any amount over 5 000 should be included in boxes 1 3 and 5 as wages social security wages and medicare wages. On the other hand you cannot cancel an employer sponsored health policy at any time. An employer decides mid year that they wish to adjust.