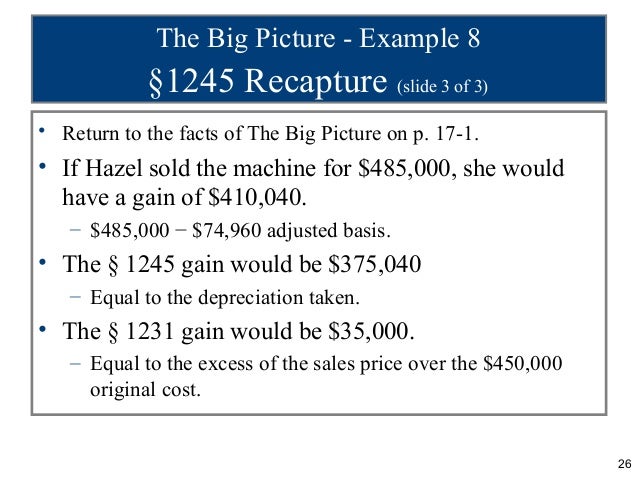

Section 1245 Recapture

The first step in evaluating depreciation recapture is to determine the cost basis of the asset.

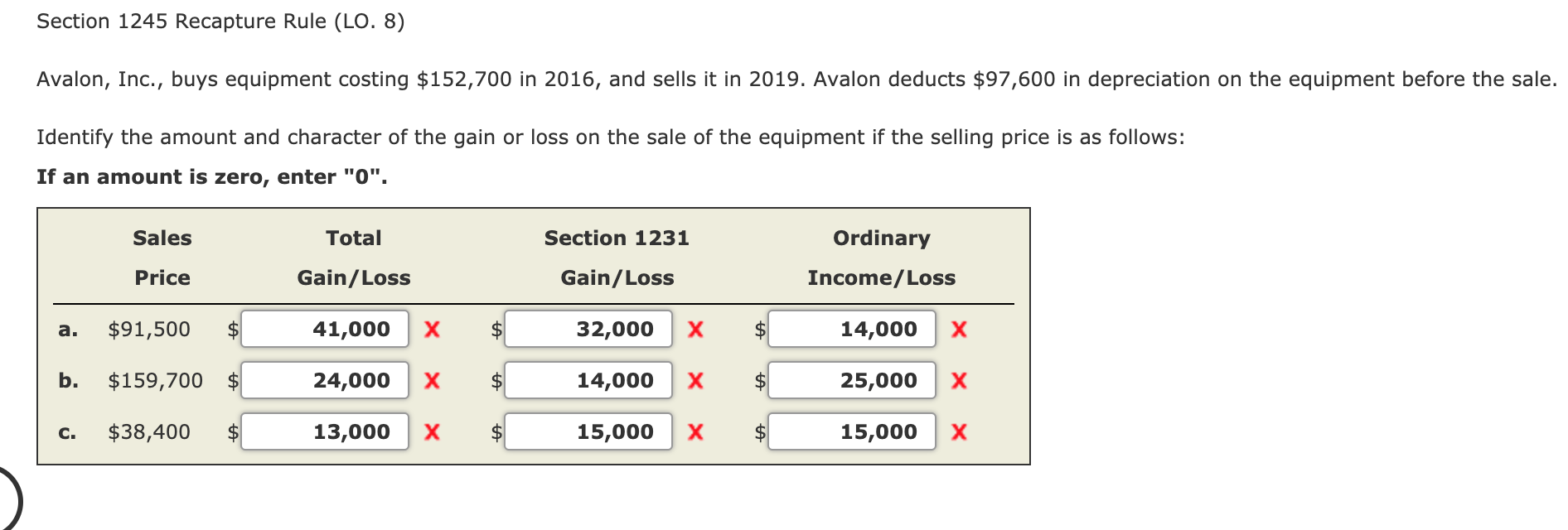

Section 1245 recapture. Section 1245 depreciation recapture. The original cost basis is the price that was paid to acquire. Recapture these two parts are taxed differently resulting in extra taxes.

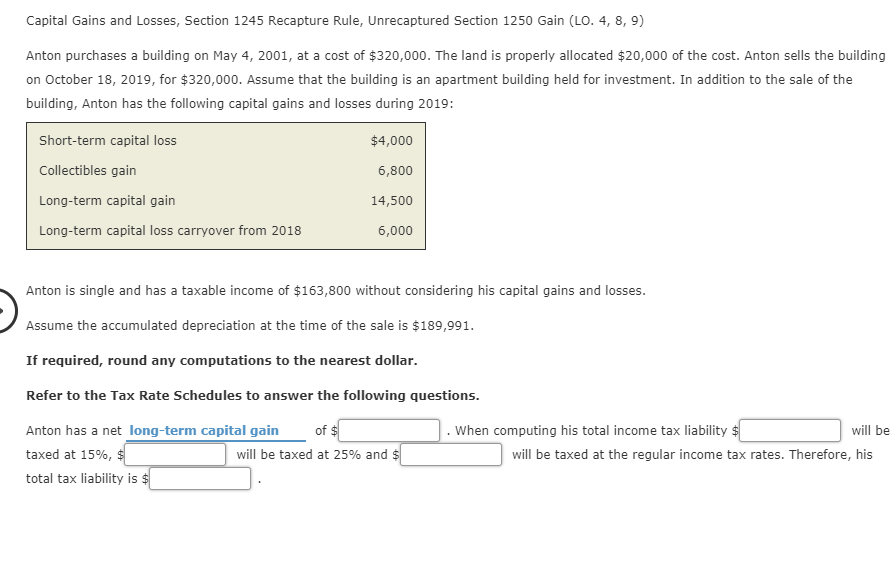

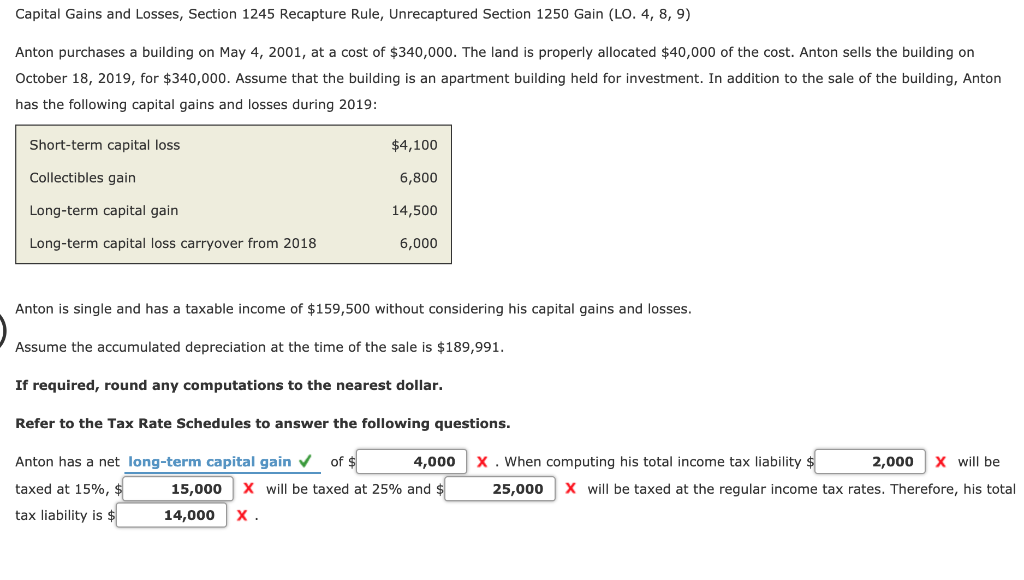

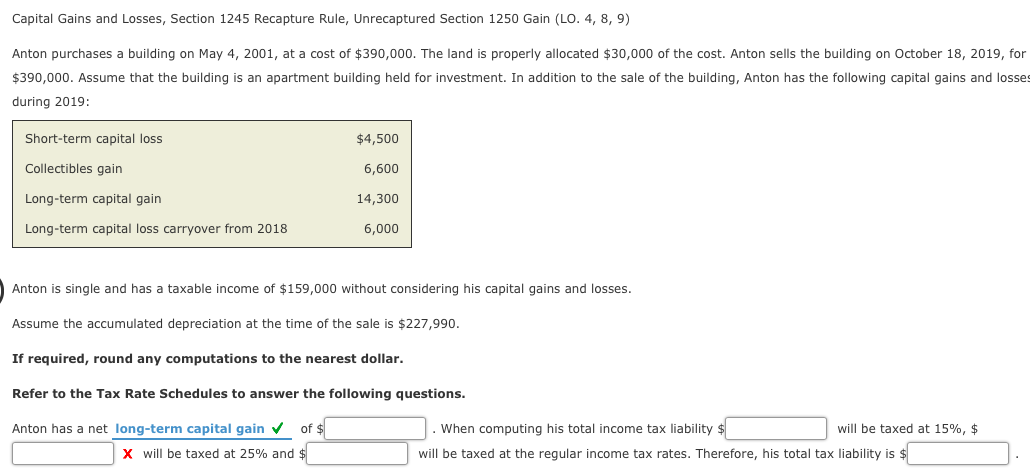

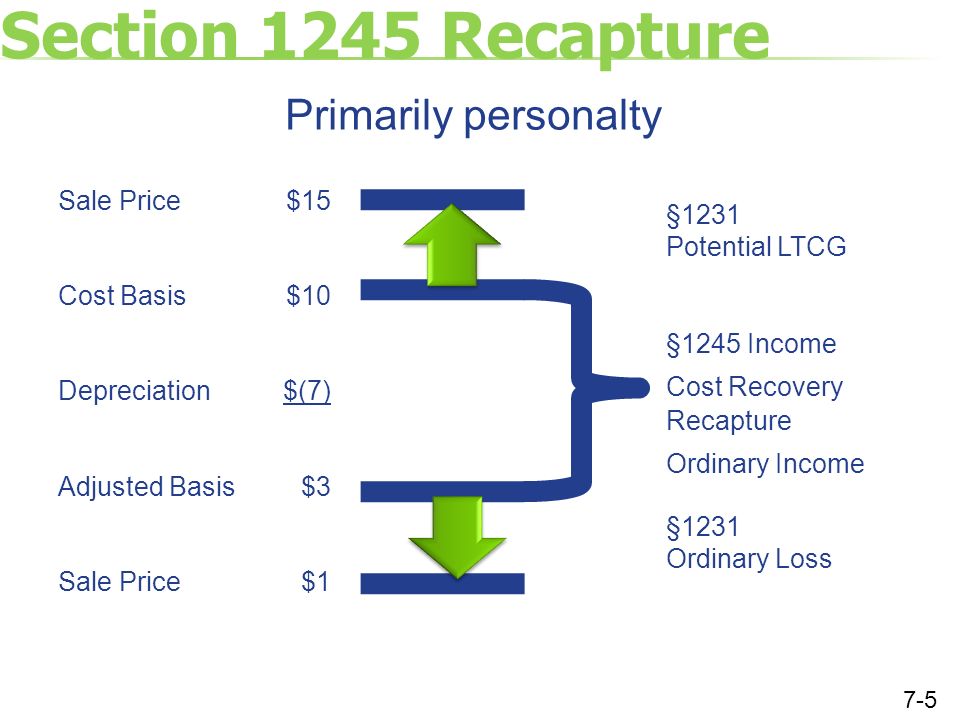

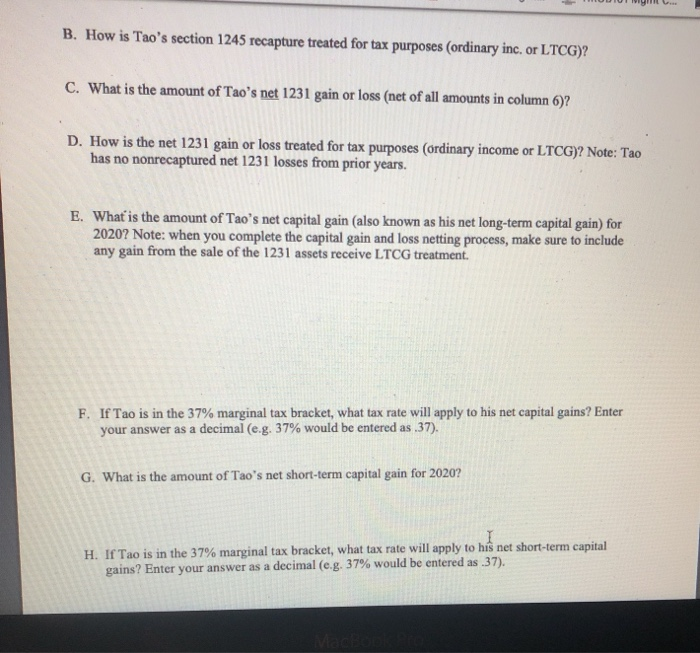

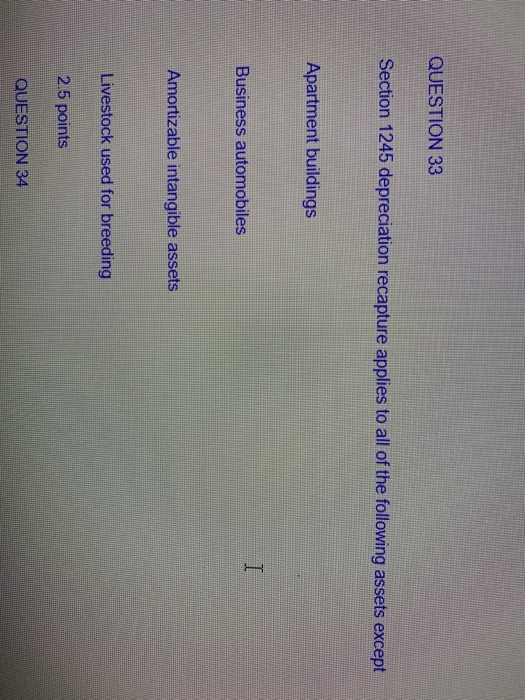

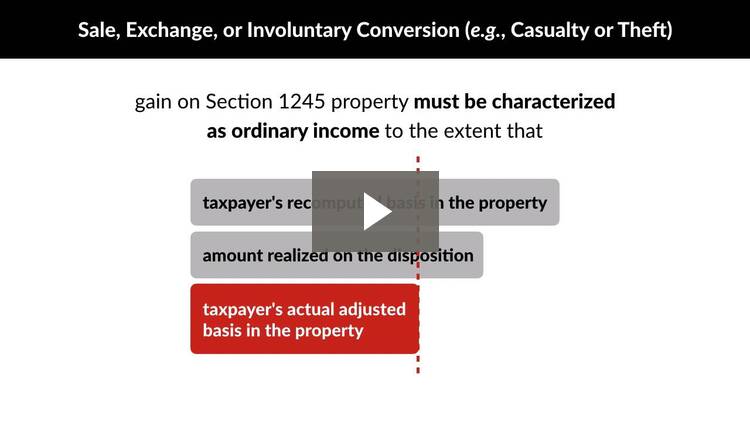

This type of property includes tangible personal property such as furniture and equipment that is subject to depreciation or intangible personal property such as a patent or license that is subject to amortization. 1245 and 1250 property are not treated the same in recapture in the case of 1250 property only accelerated depreciation taken in excess of straight line depreciation is considered ie for land improvements all accelerated deprecation 1245 or 1250 is recaptured at ordinary rates currently 37 for individuals 25. The part of the gain that is due to depreciation recapture is treated as ordinary income.

Ordinary income is typically taxed at a higher income tax rate than long term gains would be. Facility for bulk storage of fungible commodities. The internal revenue code includes multiple classifications for property.

99 514 201 d 11 b amended par. Gain treated as ordinary income. Bloomberg tax portfolio depreciation recapture sections 1245 and 1250 no.

All three of the following must be true in order for depreciation recapture to occur. Sections 1245 and 1250 were enacted to close the loophole that resulted from allowing depreciation deductions on assets to offset ordinary income while taxing gain from the sale of these. Avoiding depreciation recapture on section 1245 property.

2 generally restating former subpars. Buildings and structural components. Section 1245 property defined.