Section 83 B Election

Example 1 83 b election.

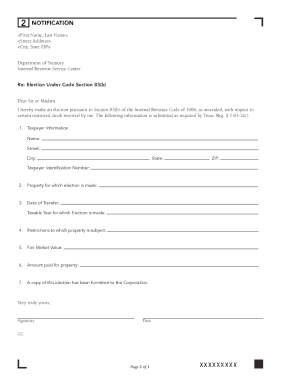

Section 83 b election. Instructions for completing irs section 83 b form 1 918978 104 page 1 of 3 xxxxxxxx 1 instructions to make an 83 b election you must complete the following steps within 30 days of your award date. Example 1 83 b election. Complete the irs 83 b form that has been provided to you.

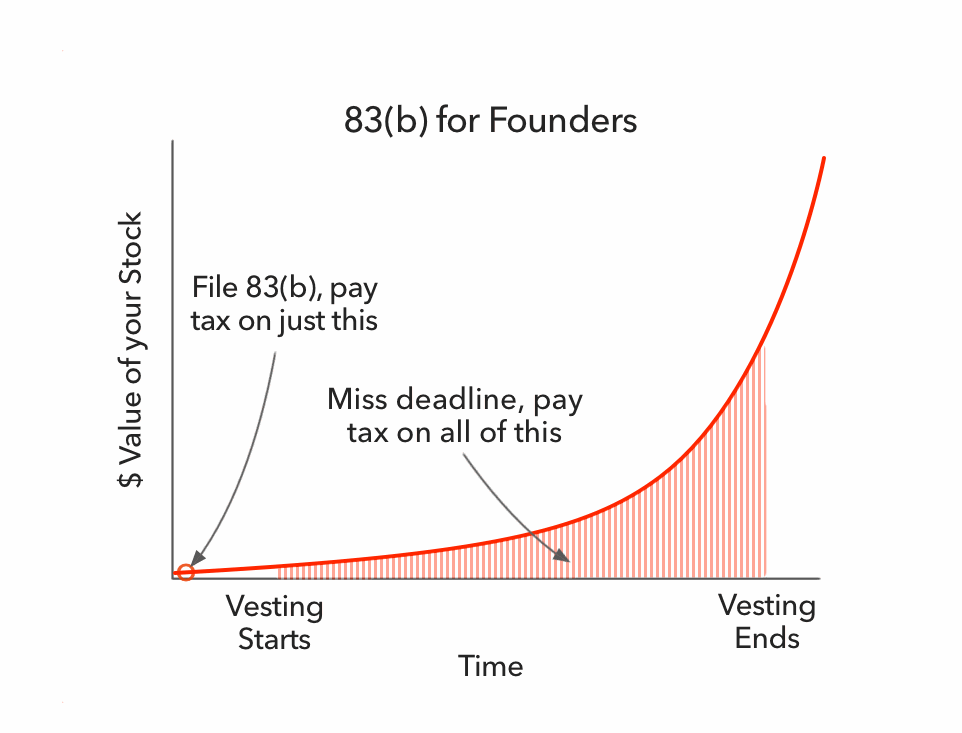

You pay ordinary income tax of 396 00 i e 1 000 x 39 6. Because you filed a section 83 b election you do not have to pay tax when the stock vests only on the sale. You pay ordinary income tax of 370 i e 1 000 x 37.

In this example you timely file a section 83 b election within 30 days of the restricted stock grant when your shares are worth 1 000. Under section 83 if you purchase stock that is subject to vesting and do not file an 83 b election you will pay income tax on the difference between the price paid for the stock and the stock s fair market value when it vests even if you do not sell the stock at that time. Because you filed a section 83 b election you do not have to pay tax when the stock vests only on the later sale.

In this example you timely file a section 83 b election within 30 days of the restricted stock grant when your shares are worth 1 000. Under section 83 b the employee in our example is permitted to make a so called section 83 b election if the election is made the employee will be required to recognize as income the fair market value of all of the granted shares as of the date of grant rather than the date of vesting.

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)