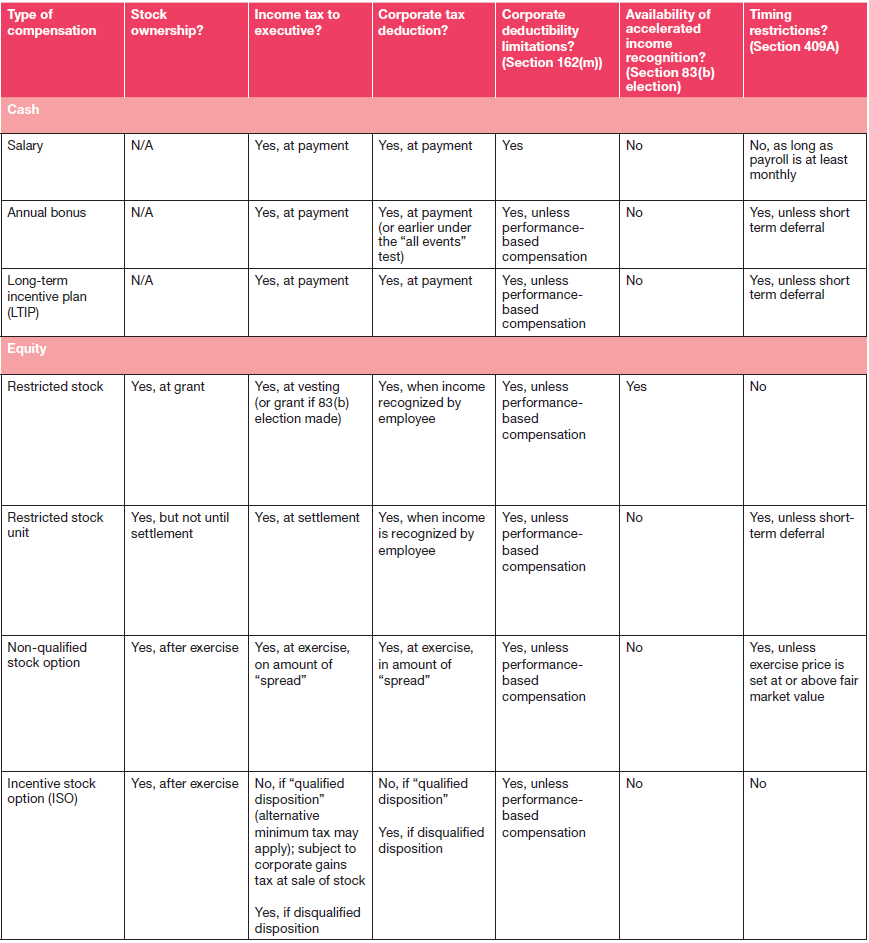

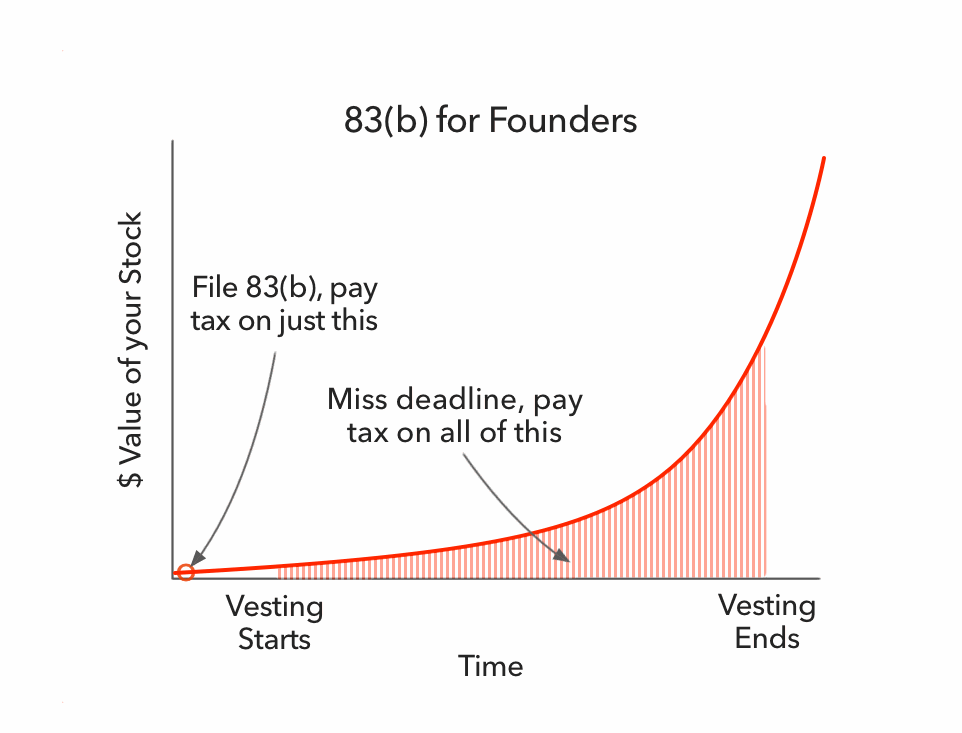

Section 83 B Election Form

You can prepare a 83 b election by completing the form at the end of this document which follows some general rules regarding the election.

Section 83 b election form. 06 under 1 83 2 c an election under 83 b is made by filing a copy of a written statement with the internal revenue service office with which the person who performed the service files his return. If your lawyer has provided you with 83 b election forms you may use those. To make an 83 b election you must complete the following steps within 30 days of your award date.

You also need to include a cover letter to the irs a template of which can be found here. The 83 b election documents must be sent to the irs within 30 days after the issuing of restricted shares. Check the instructions to form 1040 if you re not sure of the address.

The irs has prepared a sample form which is available here and forms for both corporations and llcs are available on the upcounsel site. To file the election one need only complete the section 83 b election form and mail it to the irs within 30 days after the equity is granted. If not then print four copies of page 9 from the 83 b election irs form here.

There is no official irs form it is just a written statement that contains information about the stock grant. Complete the irs 83 b form that has been provided to you. You must file the form no later than the 30thday after the date of grant of the restricted shares with the irs office at which you file your federal income tax return.

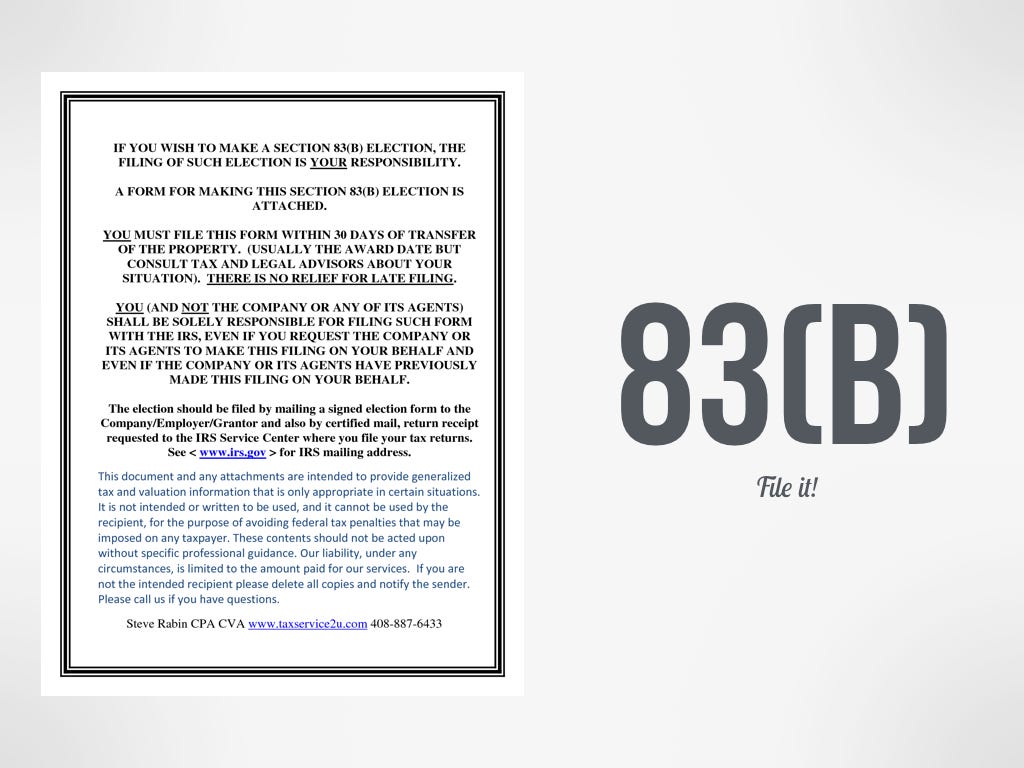

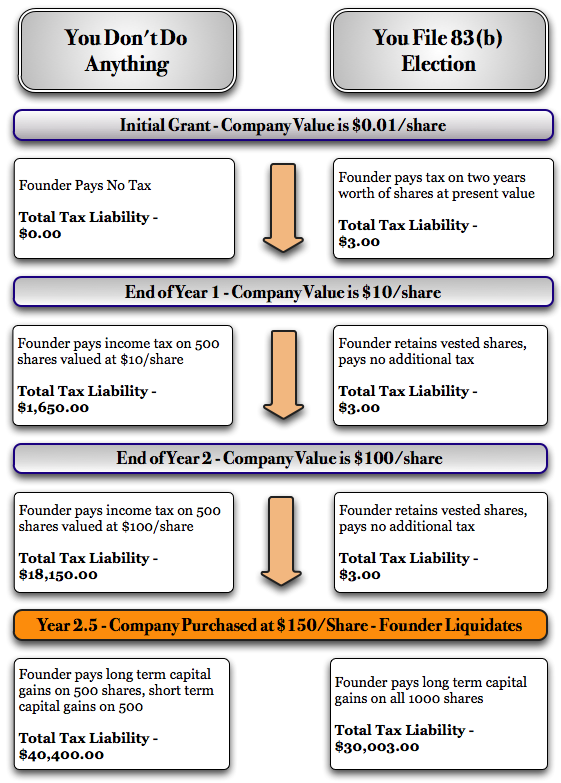

1 918978 104page 1 of 3xxxxxxxx. Because you filed a section 83 b election you do not have to pay tax when the stock vests only on the sale. Under 83 b an election can be made to recognize income currently upon the transfer of restricted property in connection with the performance of services.

An 83 b election form is a written statement to the irs telling them that you have been granted restricted stock from a company where you will be providing services employment consulting etc. When not to take the election. Instructions for completing irs section 83 b form.

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)