Section 704 C

The partnership will show the portion of income or deduction items allocated to you under section 704 c.

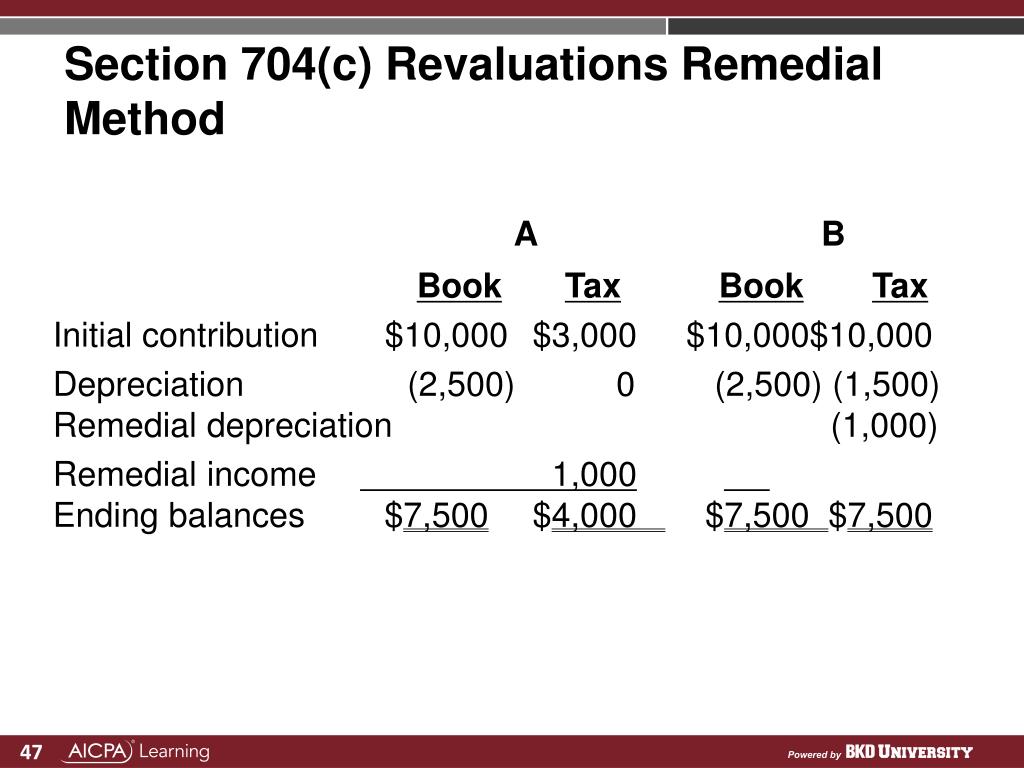

Section 704 c. While many may presume that section 704 c is a complex set of tax rules that only apply to specific or complex transactions it is key to remember that even a relatively straightforward transaction can create section 704 c attributes. Section 704 c property means any property that is contributed to the company at a time when its adjusted tax basis for federal income tax purposes differs from its fair market value and any company property that is revalued for book purposes at a time when its adjusted tax basis for federal income tax purposes differs from its fair market value. Section 704 c is intended to ensure that when a partner contributes built in gain or built in loss property to the partnership the contributing partner will bear and cannot shift to the other partners the tax consequences of the built in gain or loss.

704 c the allocation of tax items for property contributed with a built in gain or loss must be made using a reasonable method. 704 c 1 b. 704 c is intended to prevent the shifting of tax items among partners when a partner contributes property with a fair market value different from its tax basis to a partnership.

Section 704 c reporting is more common than most expect. Section 704 c tax allocations are determined after section 704 b book allocations are determined. B determination of distributive sharea partner s distributive share of income gain loss deduction or credit or item thereof shall be determined in accordance with the partner s interest in.

This is for information purposes only. A effect of partnership agreement. The purpose of section 704 c is to prevent taxable gain or loss inherent in property at time of contribution from being shifted to another partner looks to the difference between adjusted tax basis and fair market value upon contribution.

A partner s distributive share of income gain loss deduction or credit shall except as otherwise provided in this chapter be determined by the partnership agreement. While all depreciation is generally shared 50 50 section 704 c principles require that the first dollars of tax depreciation be allocated to the non contributing partner b until b has received.