Section 663 B Election

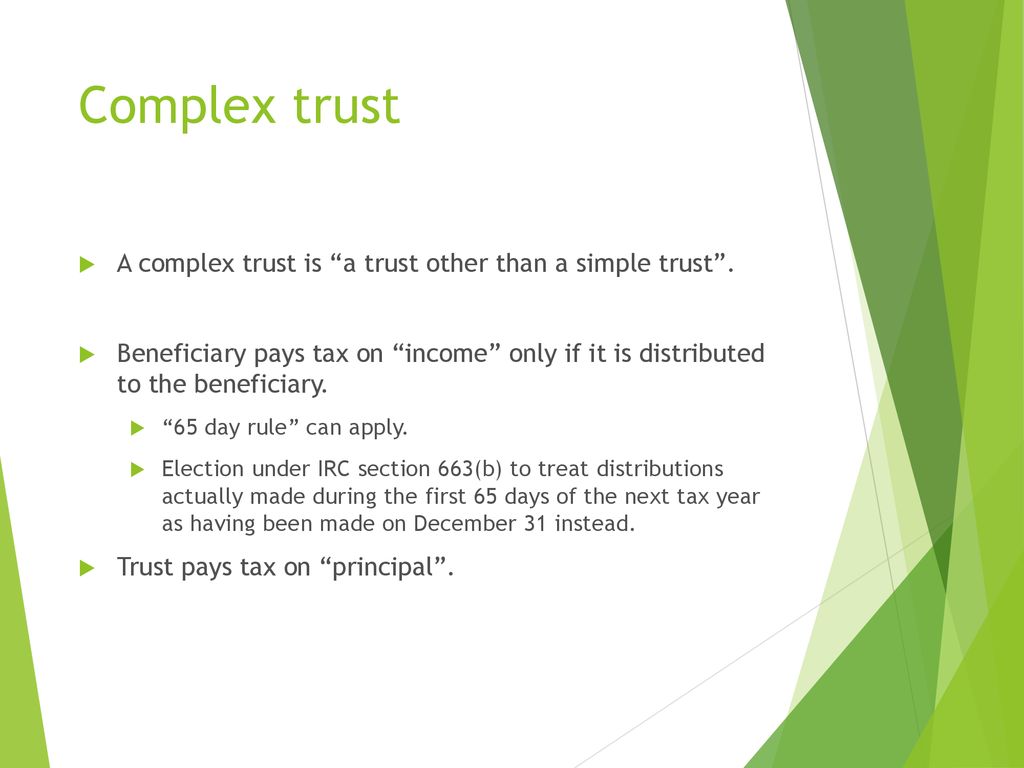

One of the tax planning tools available to trustees of estates and complex trusts is the irc section 663 b election also known as the 65 day rule simply put a 663 b election allows distributions made to beneficiaries within 65 days of year end to be counted as prior year distributions.

Section 663 b election. With respect to taxable years beginning after december 31 1968 the fiduciary of a trust may elect under section b to 663 treat any amount or portion thereof that is properly paid or credited to a beneficiary within the first 65 days following the close of the taxable year as an amount that was properly paid or credited on the last day of such taxable year. B only to a trust a which was in existence prior to january 1 1954 and b which under the terms of its governing instrument may not distribute in any taxable year amounts in excess of the income of the preceding taxable year. The section 663 b election aka 65 day rule allows the trustee to make distributions to trust beneficiaries for the first 65 days of a calendar year for the previous tax year not the following year.

Simply put a 663 b election allows distributions made to beneficiaries within 65 days of year end to be counted as prior year distributions. The election under 1 663 b 2 a 1 shall be made not later that the time prescribed by law for filing such return including extensions thereof. One of the tax planning tools available to fiduciaries of estates and non grantor trusts is the 663 b election also known as the 65 day rule.

Section 1 663 b 2 a 1 of the income tax regulations provides that if a trust return is required to be filed for the taxable year of the trust for which the election is made the election shall be made in the appropriate place on such return. Section 663 b allows a trustee or executor to make an election to treat all or any portion of amounts paid to beneficiaries within 65 days of the close of the trust s or estate s tax year as though they were made on the last day of the prior tax year. Part of former second sentence which required the election to be made for first taxable year to which this part is applicable.

The 663 b election or 65 day rule allows trustees additional flexibility to manage the tax liability of a complex trust and its beneficiaries. Under section 663 b of the internal revenue code any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year. Be sure to keep track of which distributions were included in the prior year if the election is made.

This blog explains how the election can be beneficial to you and how it is made.