Section 404 Sox

Sox section 404 a was phased in based on an issuer s size.

Section 404 sox. The purpose of sox is to reduce the possibilities of corporate fraud by increasing the stringency of procedures and requirements for financial reporting. Section 404 is the most complicated most contested and most expensive to implement of all the sarbanes oxley act sections for compliance. All annual financial reports must include an internal control report stating that management is responsible for an adequate internal control structure and an assessment by management of the effectiveness of the control structure.

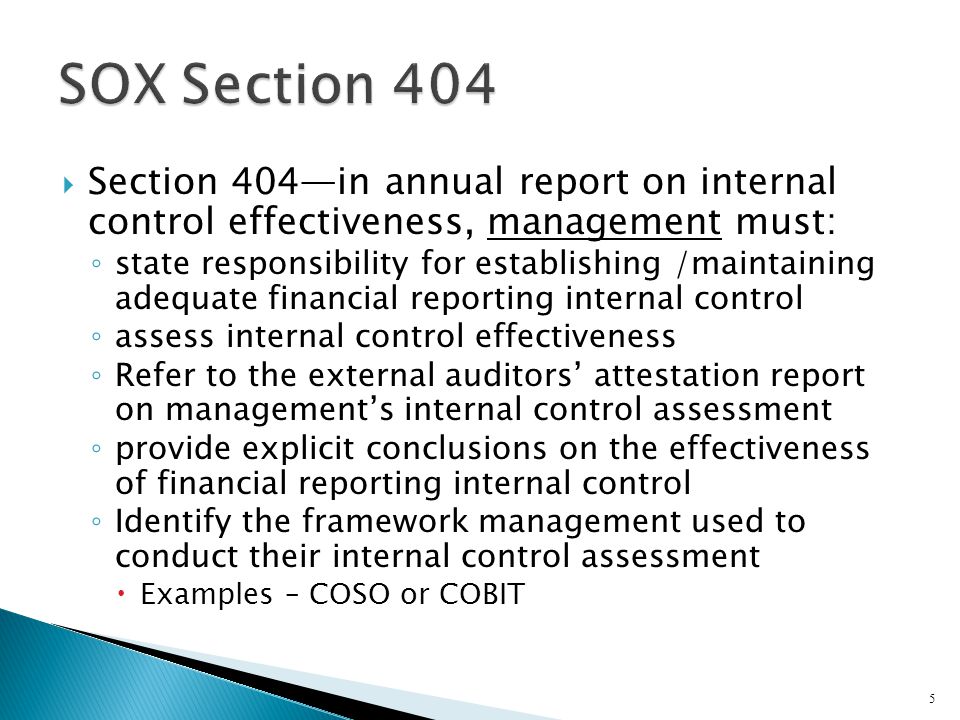

Management assessment of internal controls. Section 404 of the sox act of 2002 requires that management and auditors establish internal controls and reporting methods to ensure the adequacy of those controls. Section 404 b of sarbanes oxley act of 2002 the sarbanes oxley act requires that the management of public companies assess the effectiveness of the internal control of issuers for financial reporting.

Since the law was enacted however both requirements have been postponed for smaller public companies. Issuers are required to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. The registered accounting firm shall in the same report attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

Other than foreign private issuers. The final rules will be effective for fiscal years ending on or after june 15 2004for sec registrants with a public float 75 million. Or for fiscal years ending on or after april 15.

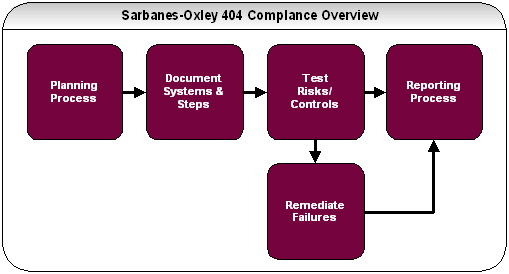

Internal control evaluation and reporting with respect to the internal control assessment each registered public accounting firm that prepares or issues the audit report for the issuer shall attest to and report on the assessment made by the management of the issuer. Sox section 404 sarbanes oxley act section 404 mandates that all publicly traded companies must establish internal controls and procedures for financial reporting and must document test and maintain those controls and procedures to ensure their effectiveness. The most contentious aspect of sox is section 404 which requires management and the external auditor to report on the adequacy of the company s internal control on financial reporting icfr.

The requirement of an auditor s attestation won t apply to most smaller public companies until their 2008 annual reports. Sarbanes oxley section 404 an introduction. Section 404 b requires a publicly held company s auditor to attest to and report on management s assessment of its internal controls.