Section 338 H 10 Election

An election to treat a stock acquisition of the target corporation generally as an asset acquisition for us federal income tax purposes.

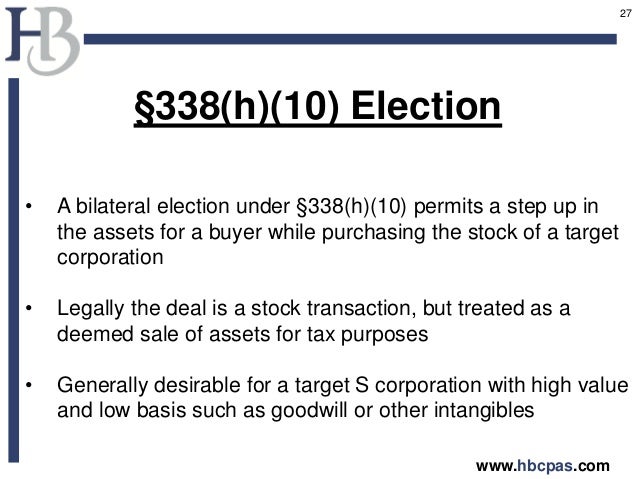

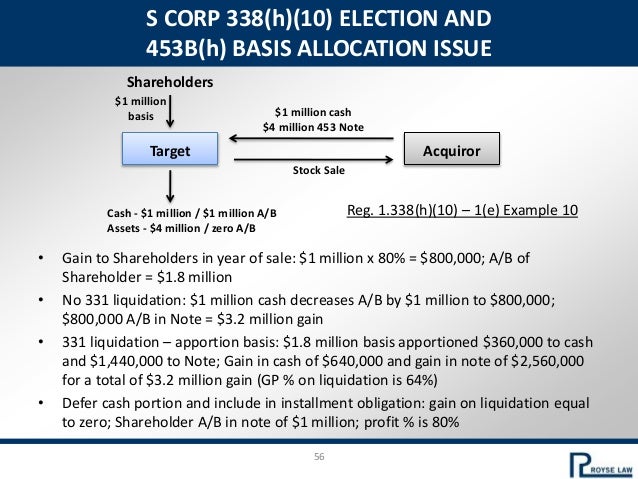

Section 338 h 10 election. A 338 h 10 election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100 of the assets of the target for tax purposes. A buyer may want to make this election if it would receive a stepped up basis in the target corporation s assets i e if the buyer s cost basis in target s assets would exceed the carryover basis it would otherwise take in a stock acquisition. Section 338 h 10 of the internal revenue code can provide significant tax benefits to a buyer of 80 or more of a target corporation.

The election is made jointly by the acquirer and sellers before the deal is consummated and the seller bears any incremental tax cost from the deemed asset sale. The entire point of a section 338 h 10 election is that allows a buyer p and seller t who engage in a stock sale to pretend they instead engaged in an asset purchase. A 338 h 10 election allows a buyer of stock of an s.

It remains a stock purchase for all other legal purposes such as contracts and licensing more on that later. Section 338 h 10 election. General requirements for a section 338 election.

If a section 338 h 10 election is made for a target form 8023 must be filed jointly by the purchasing corporation and the common parent of the selling consolidated group or the selling affiliate or an s corporation shareholder s. Generally a purchasing corporation must file form 8023 for the target. These elections treat a stock acquisition as an asset acquisition asset purchase vs stock purchase asset purchase vs stock purchase two ways of buying out a company and each method benefits the buyer and seller in different ways.

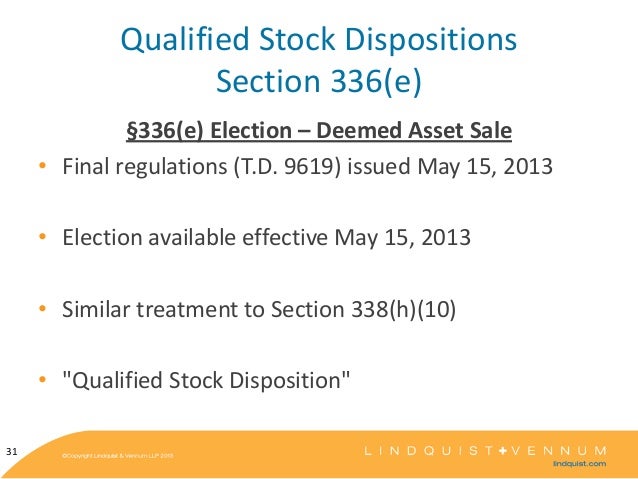

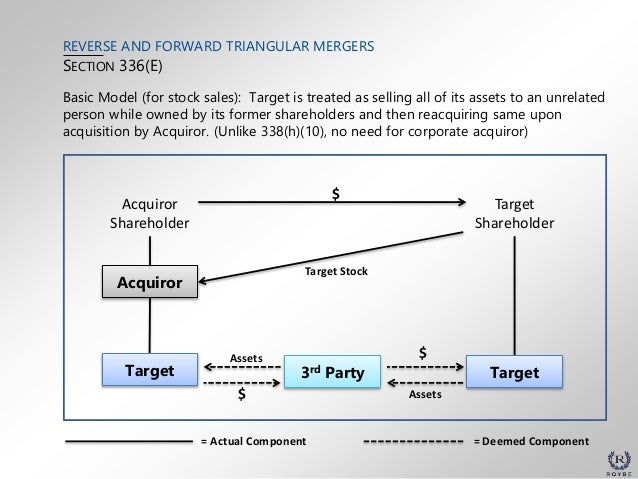

In simple terms a 338 h 10 is a tax election for a qualified stock purchase qsp which recharacterizes a stock purchase as an asset purchase for federal tax purposes. The so called regular section 338 election under section 338 g and the other under section 338 h 10. Section 338 provides two elections.

Seller and buyer shall jointly make or cause to be made and will take any and all action necessary to effect a timely election under section 338 h 10 of the code and any comparable elections under state and local income tax law with respect to the company the election. Section 338 h 10 of the internal revenue code can provide significant tax benefits to a buyer of 80 or more of a target corporation.