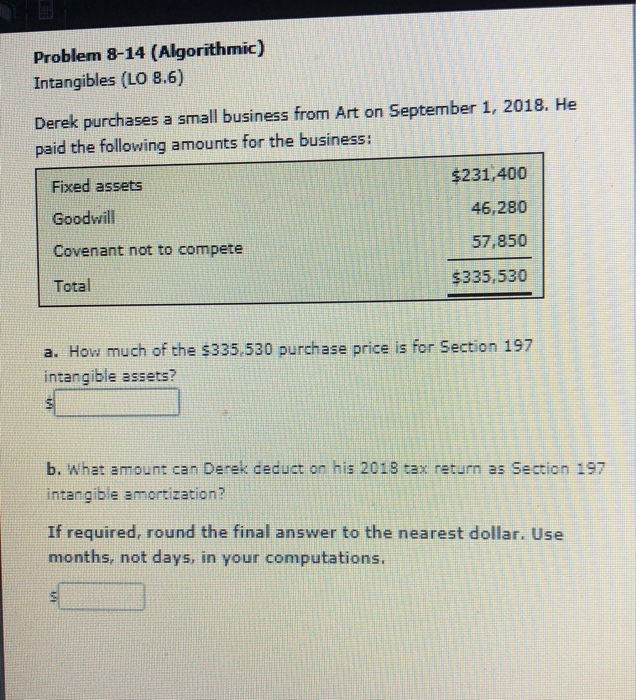

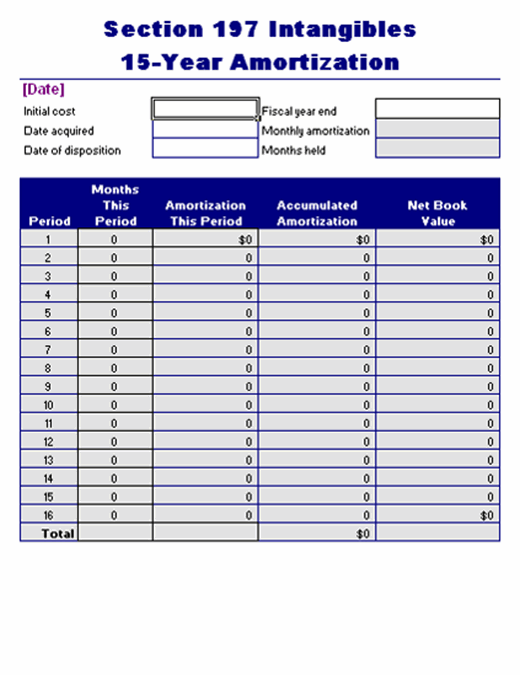

Section 197 Intangibles

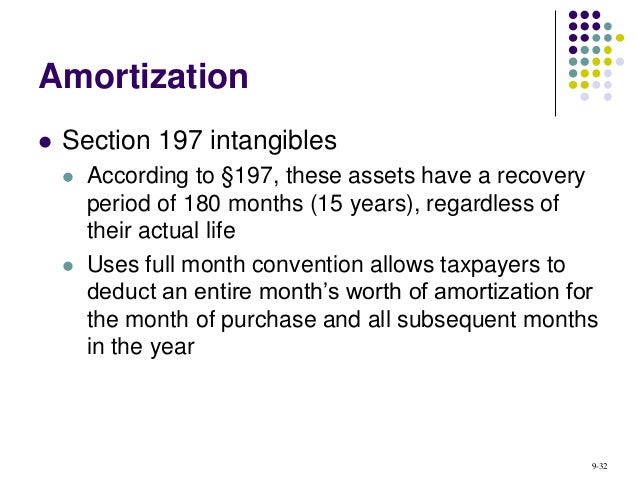

These intangible assets must usually be amortized over 15 years.

Section 197 intangibles. It includes things such as. You must amortize these costs if you hold the section 197 intangibles in connection with your trade or business or in an activity engaged in for the production of income. Publication 535 business expenses section 197 intangibles disposition of section 197 intangibles.

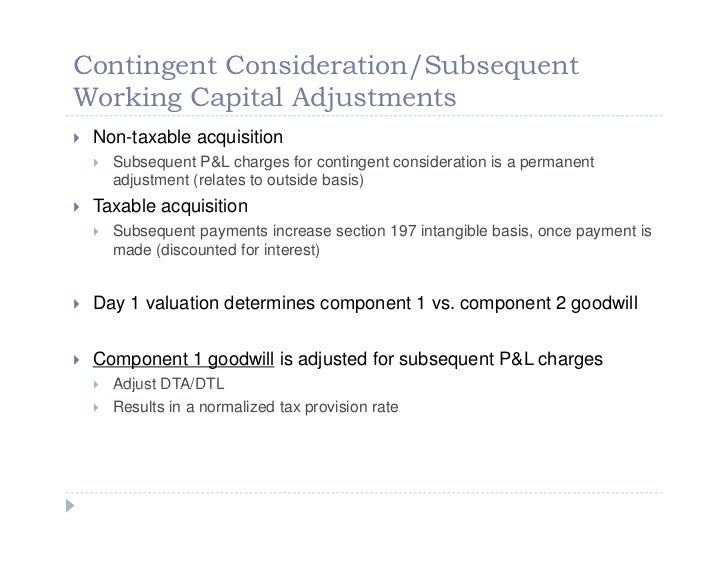

You must amortize these costs if you hold the section 197 intangibles in connection with your trade or business or in an activity engaged in for the production of income. It also includes any term interest in any section 197 intangible whether the interest is outright or in trust. Section 197 intangibles are certain intangible assets acquired after august 10 1993 or after july 25 1991 if chosen in connection with the acquisition of a business which must be amortized over 15 years from the date of acquisition regardless of the assets useful life.

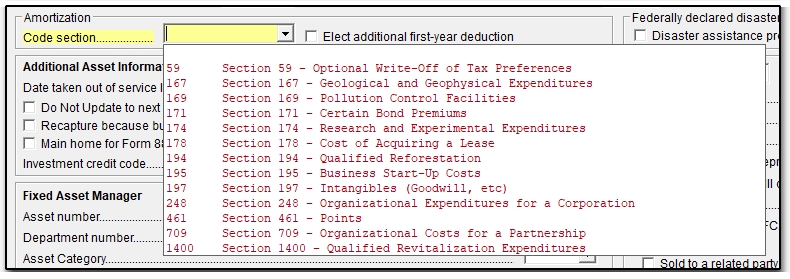

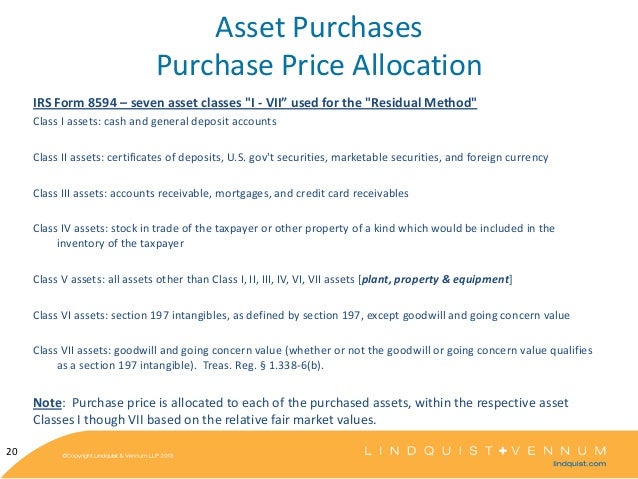

The irs designates certain assets as intangible assets under section 197 of the internal revenue code. Section 197 intangibles include any right under a license contract or other arrangement providing for the use of any section 197 intangible. Section 197 amortization rules apply to some business assets but not to others.

A taxpayer shall be entitled to an amortization deduction with respect to any amortizable section 197 intangible. A section 197 intangible is treated as depreciable property used in. The amount of such deduction shall be determined by amortizing the adjusted basis for purposes of determining gain of such intangible ratably over the 15 year period beginning with the month in which such intangible was acquired.

You start amortization the month the intangible is acquired. Section 197 intangibles include any license permit or other right granted by a governmental unit including for purposes of section 197 an agency or instrumentality thereof even if the right is granted for an indefinite period or is reasonably expected to be renewed for an indefinite period. Goodwill business books and records a patent a license and a covenant not to compete.