Section 179 Carryover

See chapter 2 for information on the section 179 deduction.

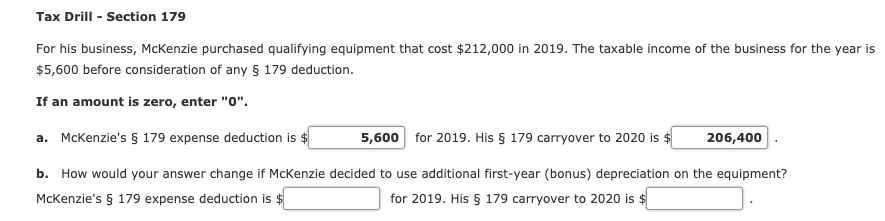

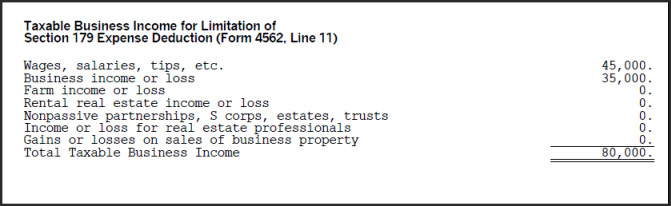

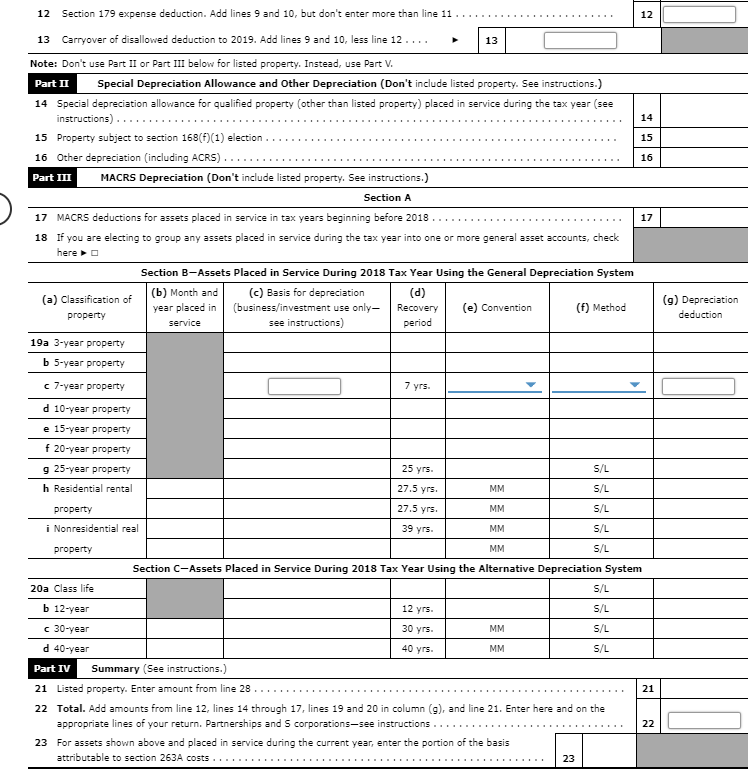

Section 179 carryover. The deduction begins to phase out on a dollar for dollar basis after 2 590 000 is spent by a given business thus the entire deduction goes away once. Check your federal carryover worksheet in your 2018 return. If the business income limit prevents an individual taxpayer from deducting all or part of the cost of section 179 property.

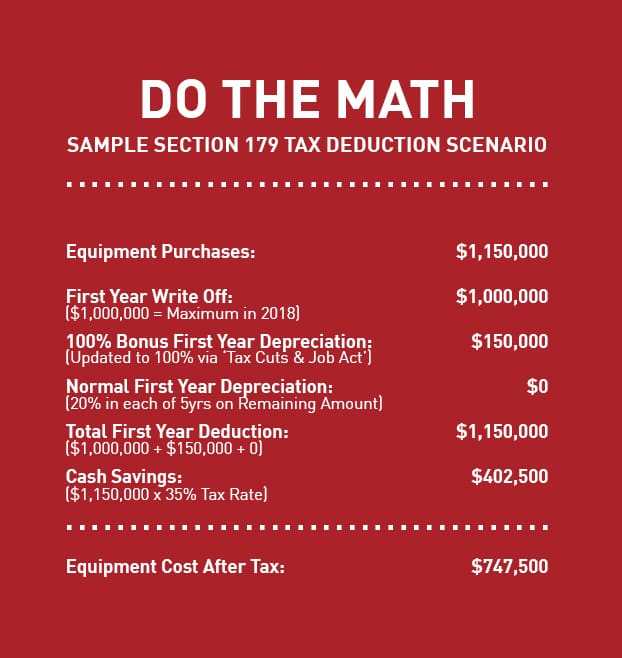

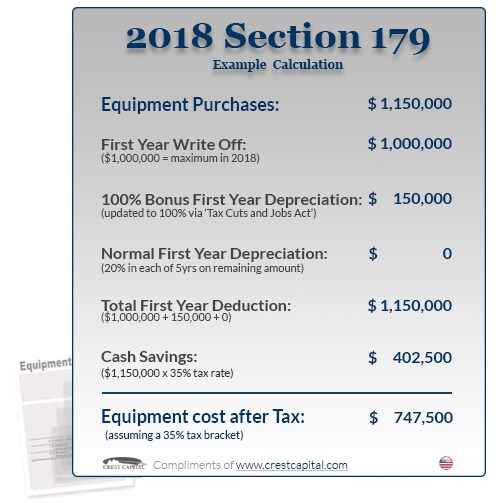

Under section 179 b 3 b a taxpayer may carry forward for an unlimited number of years the amount of any cost of section 179 property elected to be expensed in a taxable year but disallowed as a deduction in that taxable year because of the taxable income limitation of section 179 b 3 a and 1 179 2 c carryover of disallowed. Depreciation for property placed in service during the current year. Section 179 does come with limits there are caps to the total amount written off 1 040 000 for 2020 and limits to the total amount of the equipment purchased 2 590 000 in 2020.

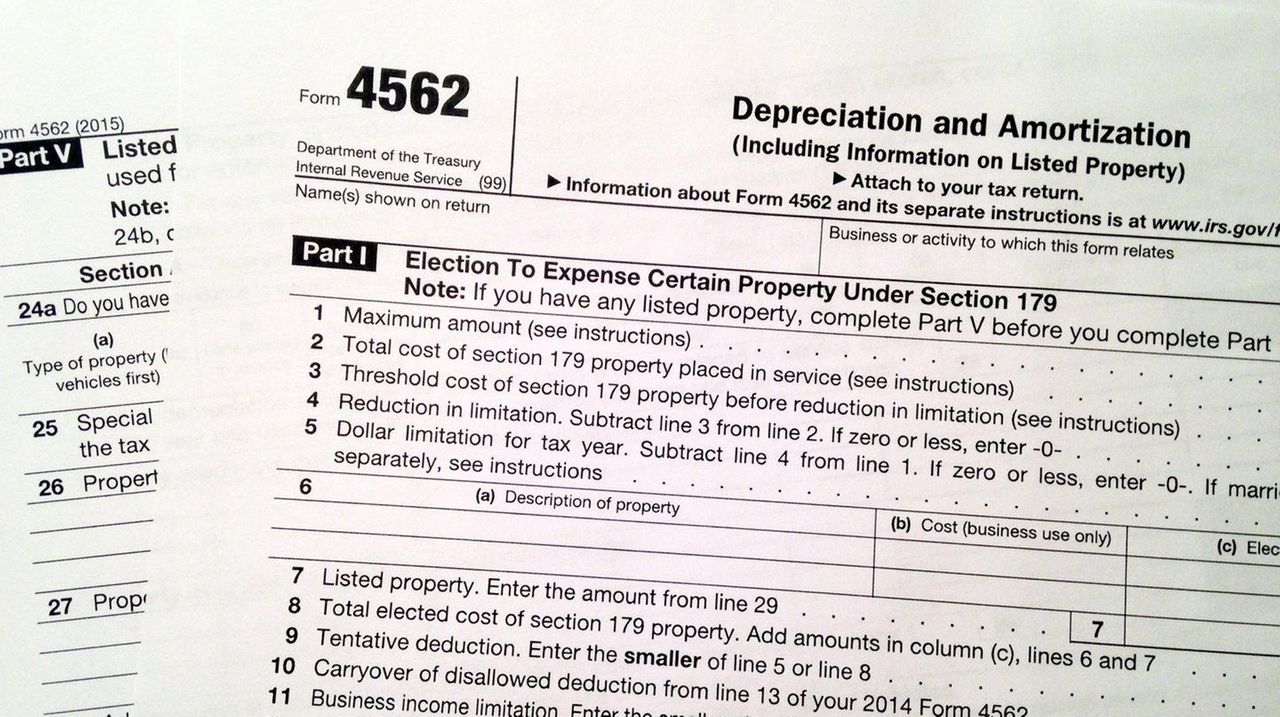

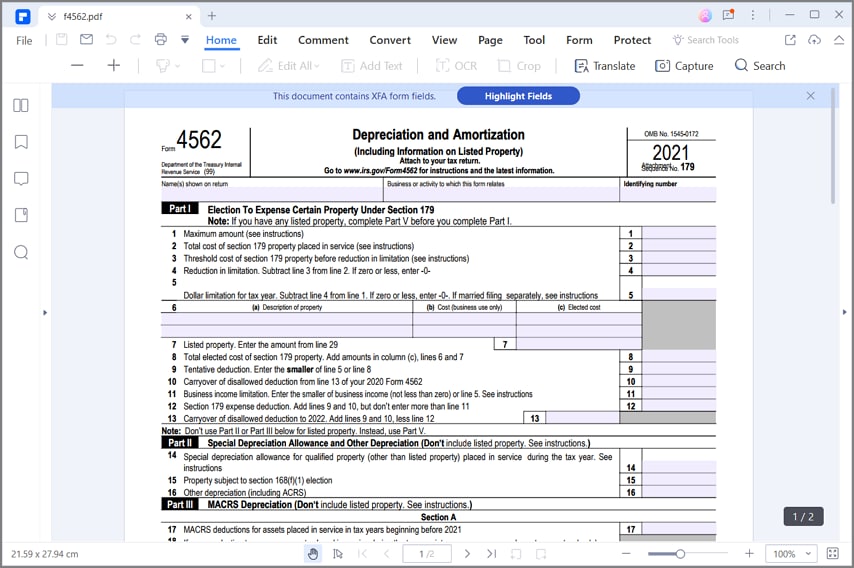

Thus it is useful to very large businesses spending more than whatever section 179 s spending limit is for that year. 8 carryover of disallowed deduction from last year individual 1040 income deductions business 6 depreciation an amortization form 4562 totals tab 8 carryover of disallowed deduction from last year partnership 1065 income deductions trade or business. Also businesses with a net loss in a given tax year qualify to carry forward the bonus depreciation to a future year.

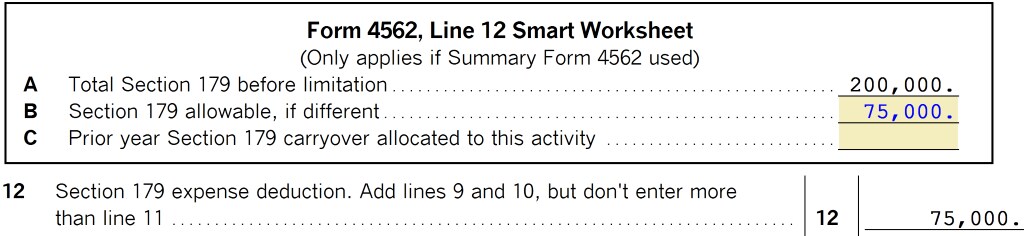

A deduction for any vehicle reported on a form other than schedule c form 1040 or 1040 sr profit or loss from business. Bonus depreciation is taken after the section 179 deduction is taken. If you had a 179 carryover from 2018 click this link for instructions on entering a 179 carryover.

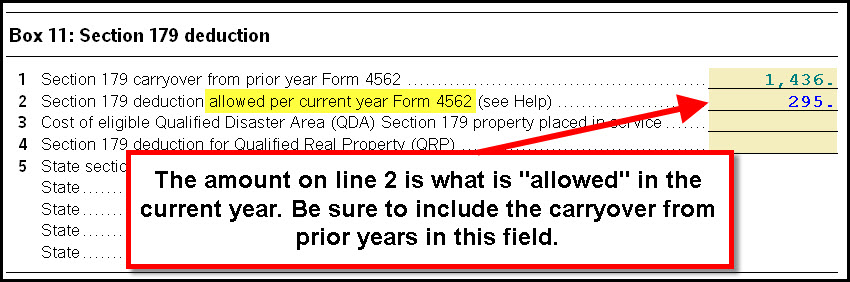

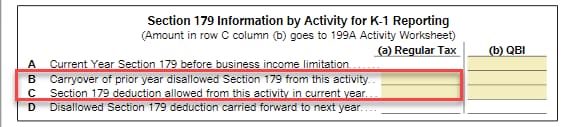

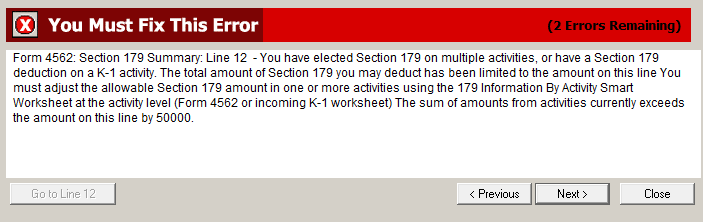

Navigate to the k 1 worksheet that generated the section 179 carryover. Section 179 carryover if you have reached your deduction limit on a given tax year you ll want to know about carryover of disallowed deduction. Depreciation on any vehicle or other listed property regardless of when it was placed in service.

To resolve this issue the carryover of section 179 must be entered on the worksheet for the activity that generated the carryover. Turbotax fills out the section 179 worksheet for you from your entries in this section. Section 179 carryover taxpayers can carry over for an unlimited number of years the cost of any section 179 property elected to be expensed but unable to be deducted because of the business income limit.