Section 1445 Of The Internal Revenue Code

Real property interest must withhold tax if the transferor is a foreign person.

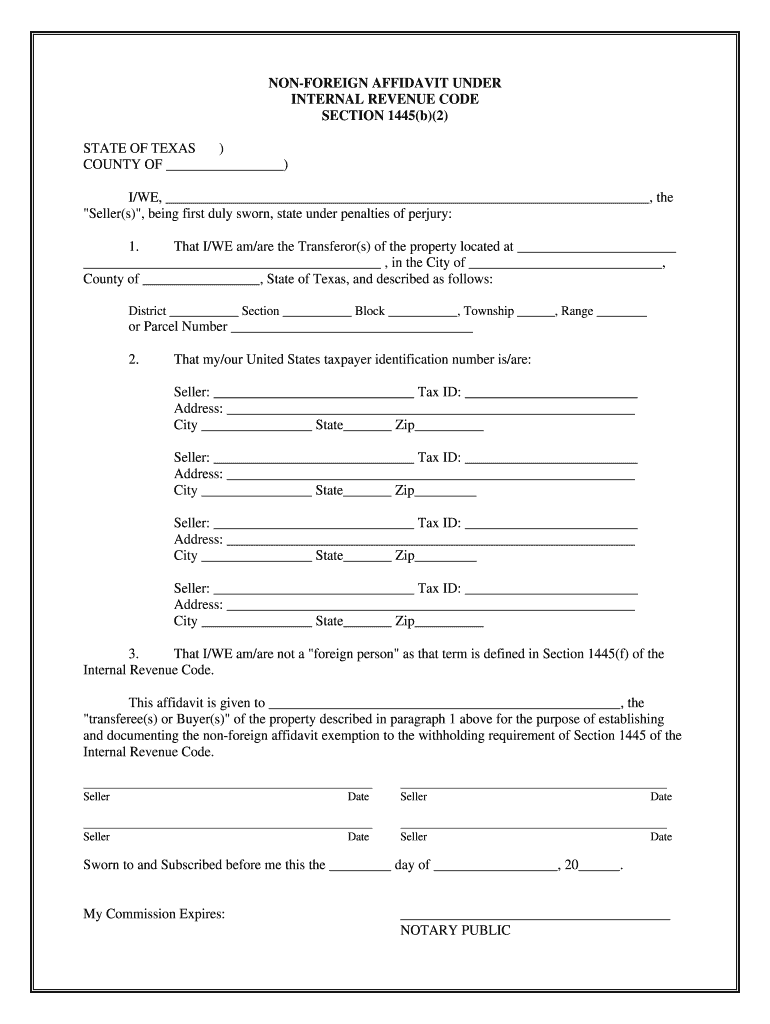

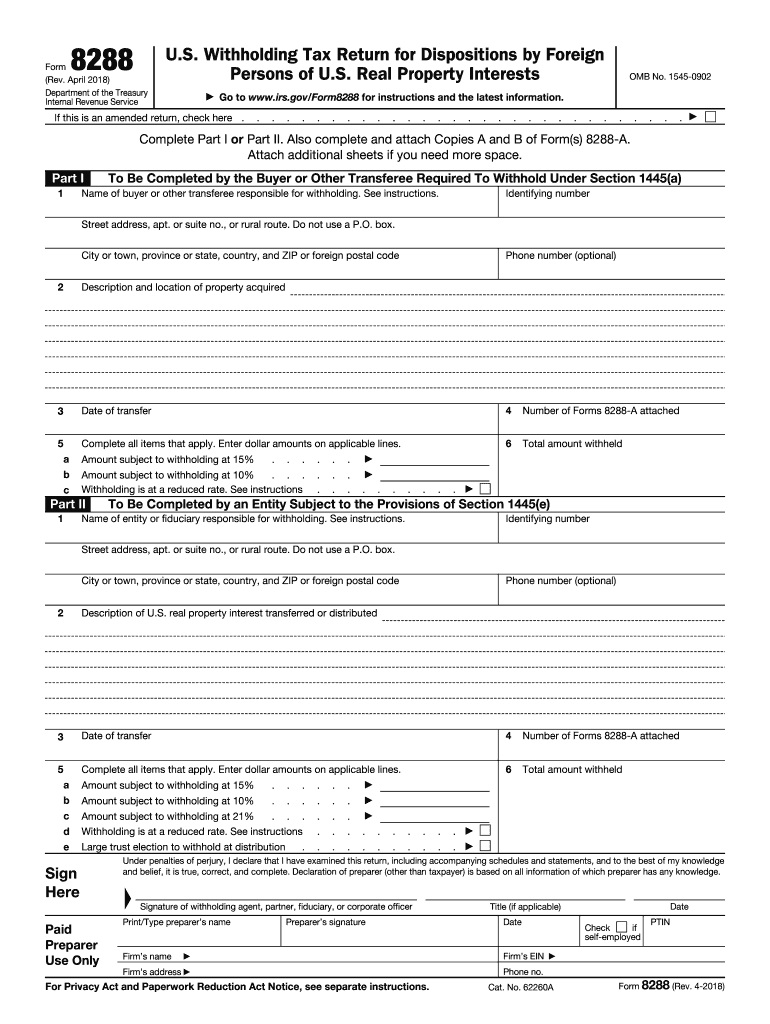

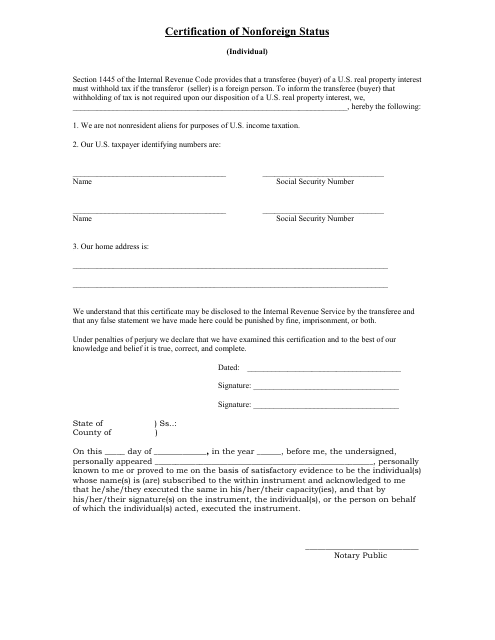

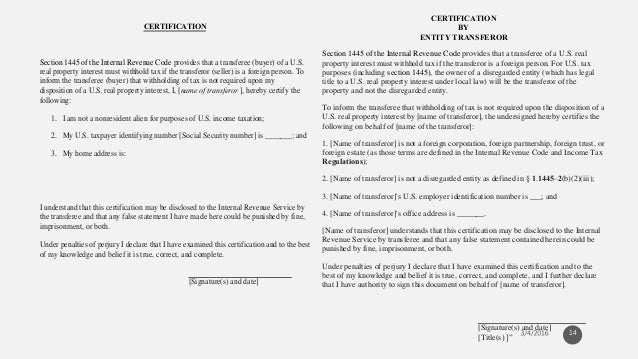

Section 1445 of the internal revenue code. 1445 a general rule except as otherwise provided in this section in the case of any disposition of a united states real property interest as defined in section 897 c by a foreign person the transferee shall be required to deduct and withhold a tax equal to 15 percent of the amount realized on the disposition. Tax purposes including section 1445 the owner of a disregarded entity which has legal title to a u s. Code 1445 withholding of tax on dispositions of united states real property interests.

Section 1445 of the internal revenue code provides that a transferee of a u s. Except as otherwise provided in this section in the case of any disposition of a united states real property interest as defined in section 897 c by a foreign person the transferee shall be required to deduct and withhold a tax equal to 15 percent of the amount realized on the disposition. Real property interest under local law will be the transferor of the property and not the disregarded entity.

Withholding of tax on dispositions of united states real property interests on westlaw findlaw codes are provided courtesy of thomson reuters westlaw the industry leading online legal research system. Real property interest from a foreign person must withhold a tax of 15 percent 10 percent in the case of dispositions described in paragraph b 2 of this section from the amount realized by the transferor foreign person or a lesser amount established by agreement with the internal revenue service. Internal revenue code 1445.

If an nra qualifies to claim the irc 121 exclusion the statutory withholding under irc 1445 on the amount realized from the sale could exceed the maximum tax liability on the sale.