Section 125 Qualifying Events

Part 1 under section 125.

Section 125 qualifying events. Hipaa requires group health plans to give special enrollment opportunities to certain employees dependents and cobra qualified beneficiaries. A loss of eligibility for group health coverage health insurance coverage schipor medicaid. A qualified benefits plan means an employee benefit plan governing the provision of one or more benefits that are qualified benefits under section 125 f.

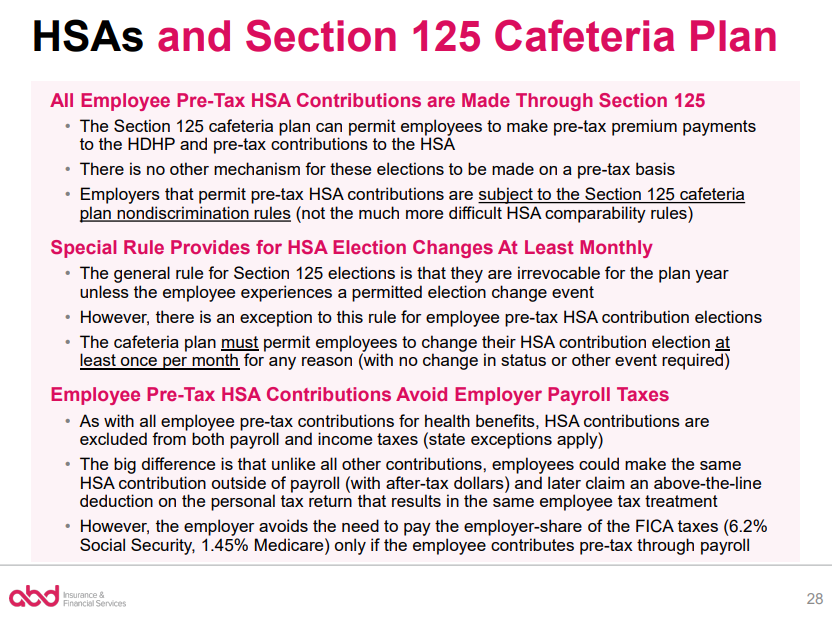

Section 125 qualifying events 1 a section 125 cafeteria plan must provide that participant elections are irrevocable and cannot be changed during the period of coverage generally the plan year. Section 125 generally provides that an employee in a cafeteria plan will not have an am ount included in gross income solely because the employee may choose among two or more benefits consisting of cash and qualified benefits a qualified benefit generally is any benefit that is excludable from gross. Under section 125 of the internal revenue code if you do decide to cancel without a qle then you and your employer would incur tax penalties.

You must request changes within 30 daysof the qualifying event or wait until the next annual open enrollment. 26 cfr 1 125 4 b a special enrollee is allowed to enroll or change his or her existing plan option in the plan after. Qualifying events the irs section 125 onlyallows changes to your group insurance elections during the plan year when an eligible change in status occurs which affects your your spouse s and or your dependent s coverage eligibility.

Be provided on a pre tax basis under section 125 an employee may make changes during a plan year only in certain circumstances. If you want to cancel an employer plan outside of the company s open enrollment it would require a qualifying life event. A plan does not fail to be a qualified benefits plan merely because it includes an fsa assuming that the fsa meets the requirements of section 125 and the regulations thereunder.

Specifically q a 8 of 1 125 1 and q a 6 b c and d of 1 125 2 permit participants to make benefit election changes during a plan year pursuant to changes in cost or coverage changes in family status.