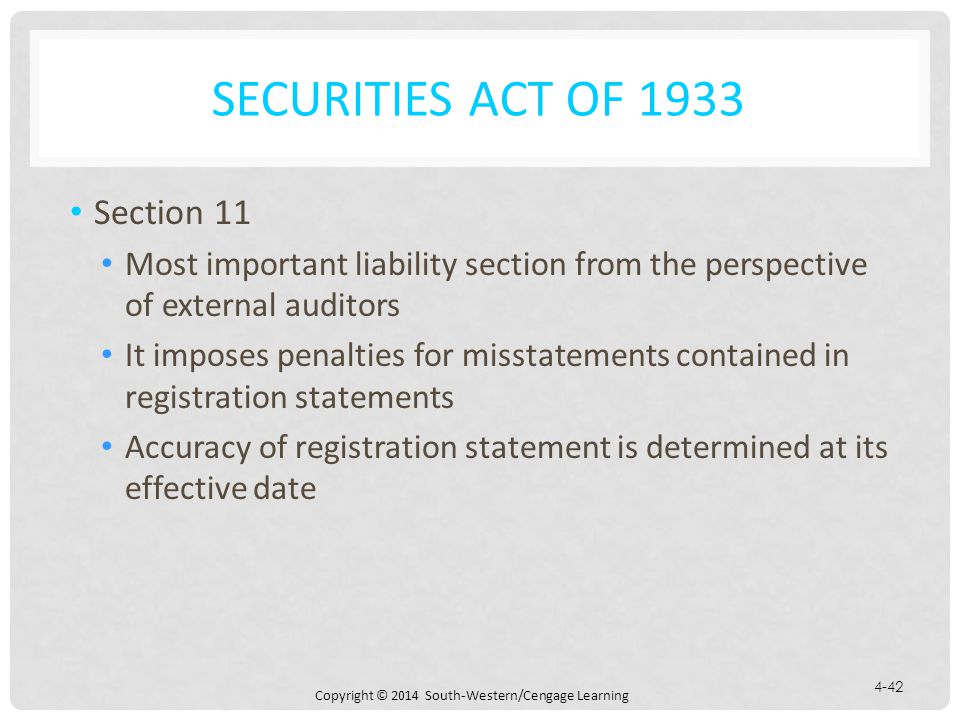

Section 11 Of The Securities Act Of 1933

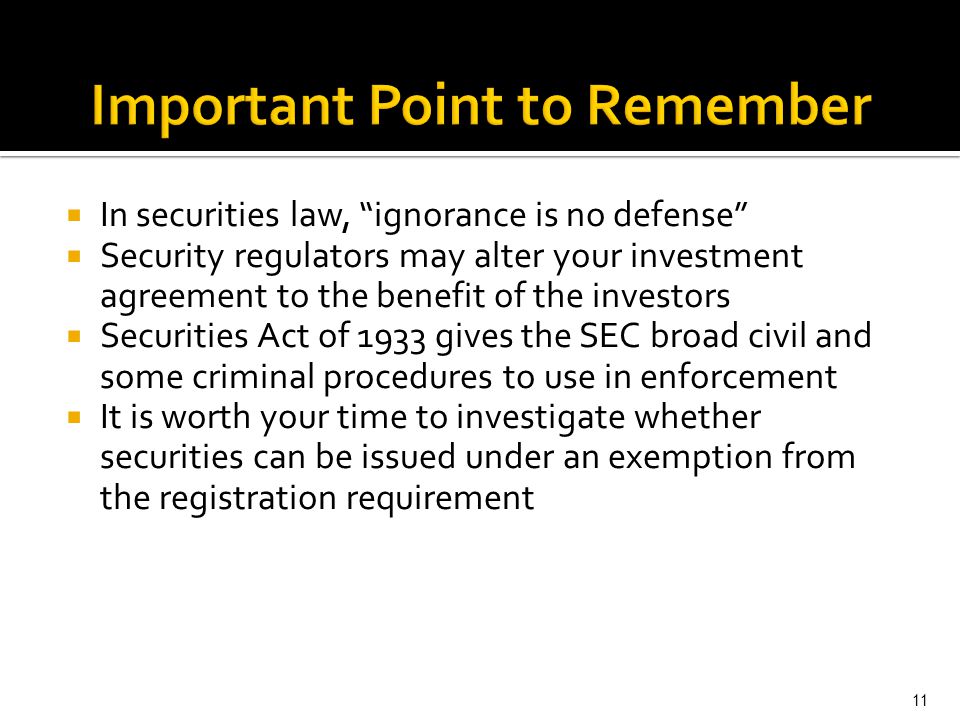

Prohibit deceit misrepresentations and other fraud in the sale of securities.

Section 11 of the securities act of 1933. The 1933 act was the first major federal legislation to regulate the offer and sale of securities. The sec can prosecute issuers and sellers of unregistered securities. Section 16 additional remedies.

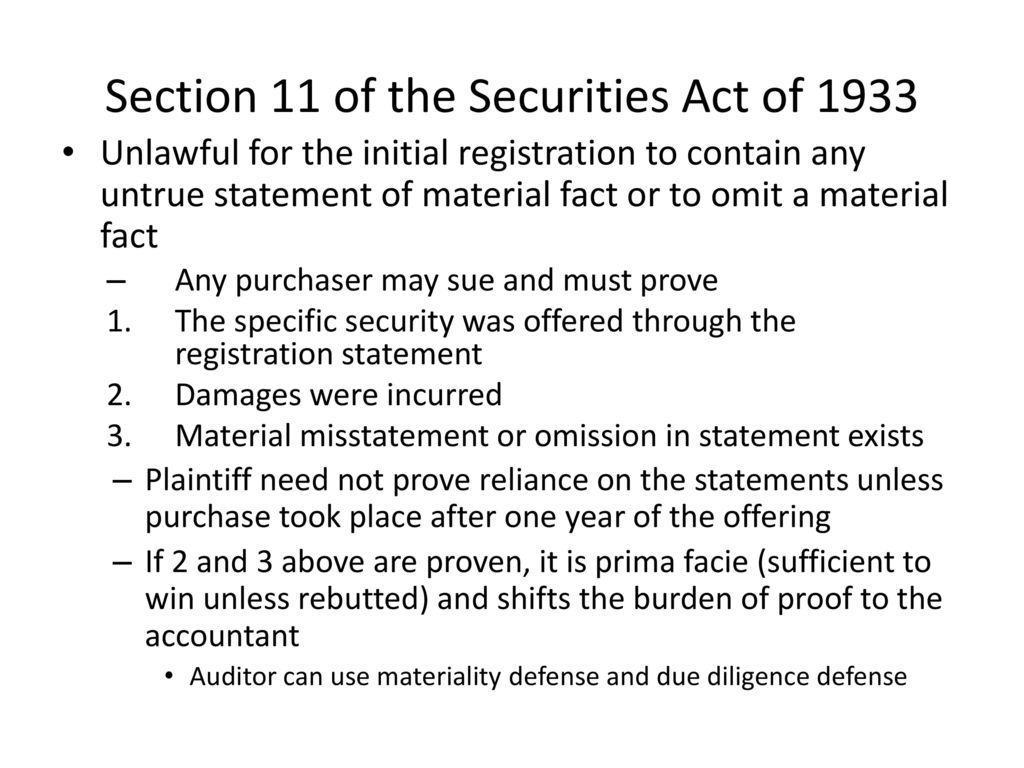

Section 11 civil liabilities on account of false registration statement. Section 13 limitation of actions. The focus of this research guide is on liability under section 11 of the securities act of 1933.

Require that investors receive financial and other significant information concerning securities being offered for public sale. At the beginning of the 1933 act congress stated that its purpose in enacting the law was to provide full and fair disclosure of the character of securities sold in. 104 67 to be deemed to create or ratify any implied right of action or to prevent commission by rule or regulation from restricting or otherwise regulating private actions under securities exchange act of 1934 15 u s c.

The primary purpose of the 33 act is to ensure that buyers of securities receive complete and accurate. Section 15 liability of controlling persons. 78a et seq see section 203 of pub.

Sec enforcement actions are the primary mechanism for enforcing federal securities laws. Nothing in amendment by pub. See the full text of the securities act of 1933.

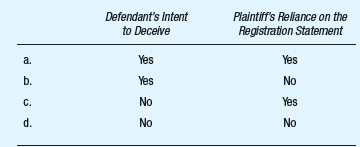

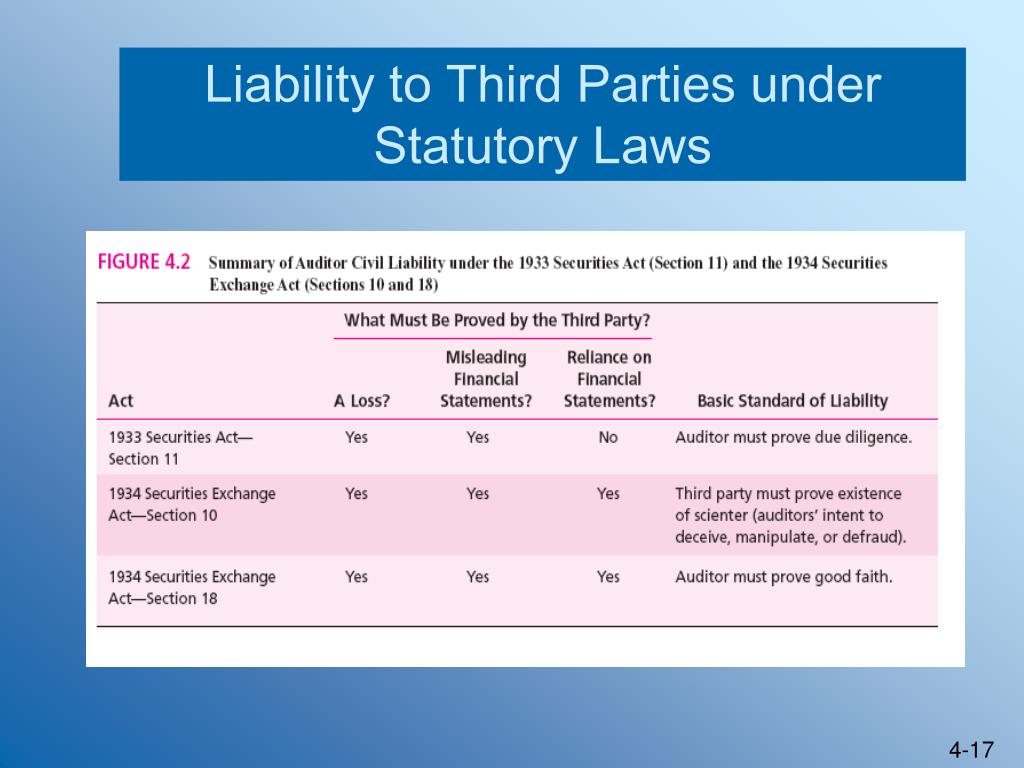

Congress enacted the securities act of 1933 to regain investor confidence in the stock market by requiring that issuers provide certain disclosures to the investing public. Specifically under section 11 of the act an investor may sue every person who signed the registration statement. Under section 11 of the securities act of 1933 and section 10 b rule 10b 5 of the securities exchange act of 1934 a cpa may be sued by a purchaser of registered securities.