List Of Vehicles That Qualify For Section 179 Deduction

However for those weighing more than 6 000 pounds many suvs meet this weight threshold there s.

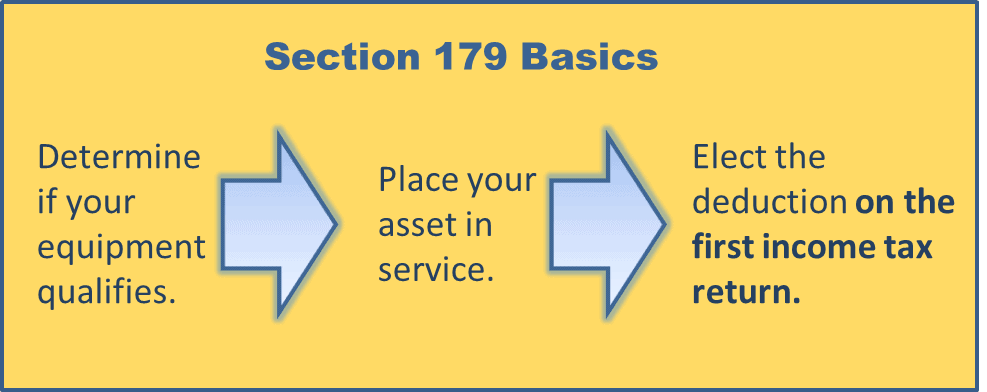

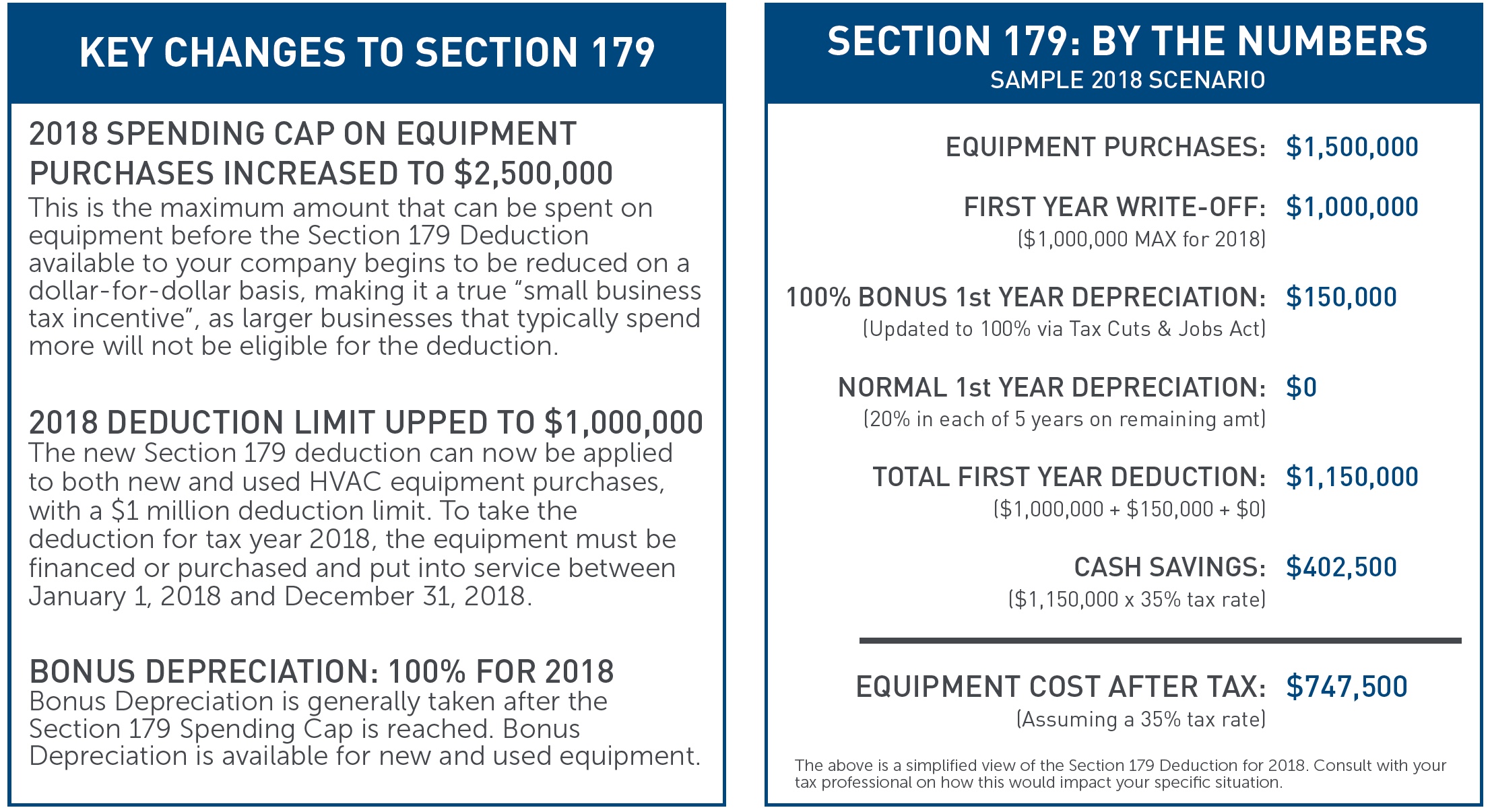

List of vehicles that qualify for section 179 deduction. To qualify for a section 179 deduction for a business vehicle it must be bought and put into service during the year in which you are applying for the section 179 deduction. Up to 25 000 of the cost of vehicles rated between 6 000 lbs gvwr and 14 000 lbs gvwr can. Equipment machines etc purchased for business use.

Additionally the vehicle must be purchased and put in use between january 1 and december 31 of the same year in order to for the section 179 deduction. Below is a list of vehicles that qualify for this exemption. However the section 179 deduction is limited to 25 000 for trucks and suvs.

For example vehicles purchased and put into service between january 1 and december 31 2020 can qualify for a 2020 section 179 deduction. Being placed in service means that a business asset is ready and available for specific use in a business or for the production of income. Please keep in mind that to qualify for the section 179 deduction the equipment listed below must be purchased and put into use between january 1 and december 31 of the tax year you are claiming.

Vehicles used in your businesses qualify but certain passenger vehicles have a total deduction limitation of 11 160 while other vehicles that by their nature are not likely to be used more than a minimal amount for personal purposes qualify for full section 179 deduction full policy statement available at. However you can check the car manufacturer s website to determine how much the vehicle weighs or you can look inside the driver s door to verify the gvw rating of the vehicle. For basic guidelines on what property is covered under the section 179 tax code please refer to this list of qualifying equipment.

Here is a list of vehicles with a gross loaded weight of over 6 000 lbs that qualify for the section 179 deduction. Special rules for heavy suvs. Most tangible goods used by american businesses including off the shelf software and business use vehicles restrictions apply qualify for the section 179 deduction.

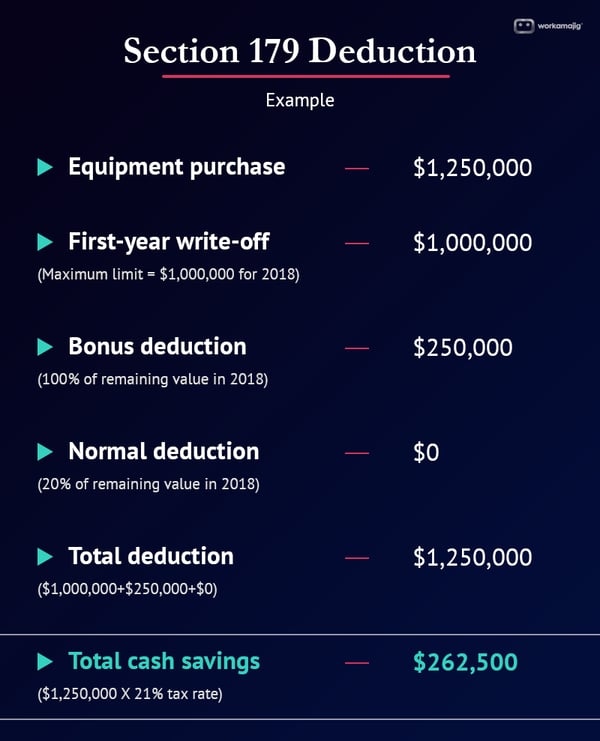

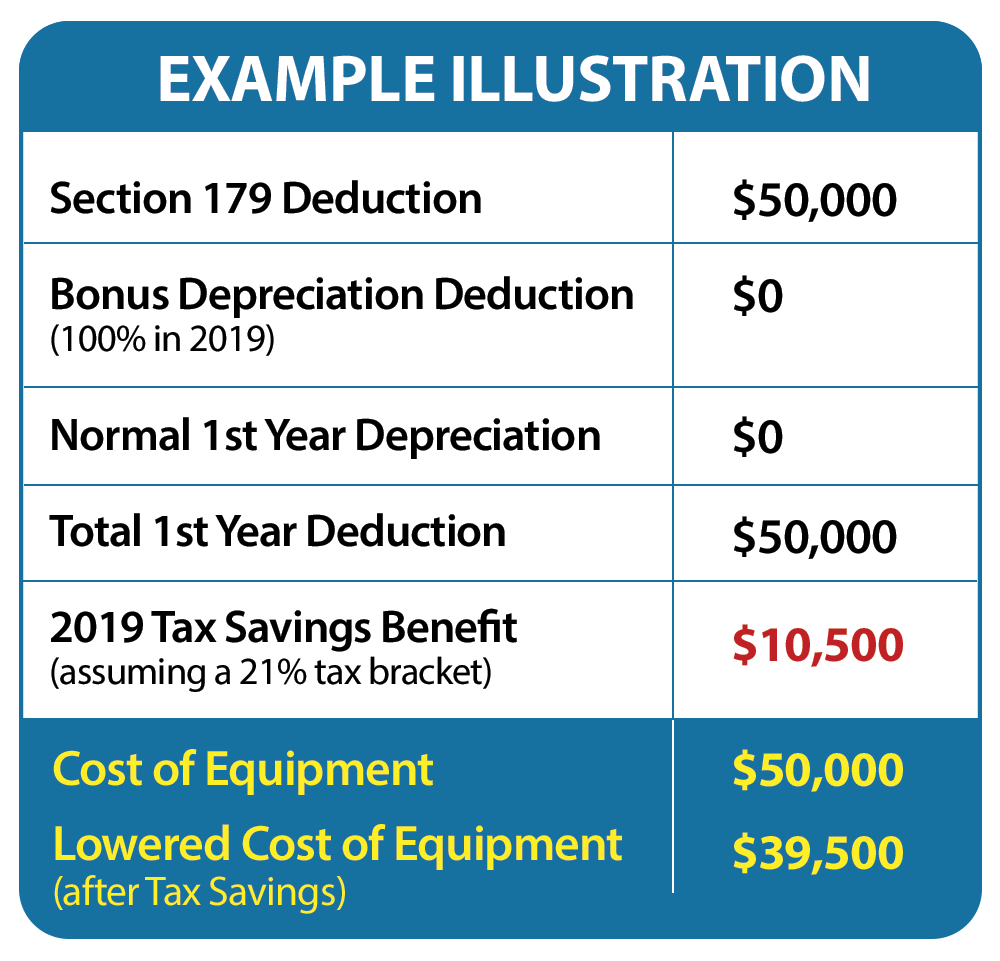

We have tried to make the list as exhaustive as possible. Please consult with a cpa before purchasing any of these vehicles and check the owner s manual. The section 179 deduction allows business owners to immediately deduct up to 1 020 000 of the cost of qualifying property and equipment purchases for the 2019 tax year.