Irc Section 482

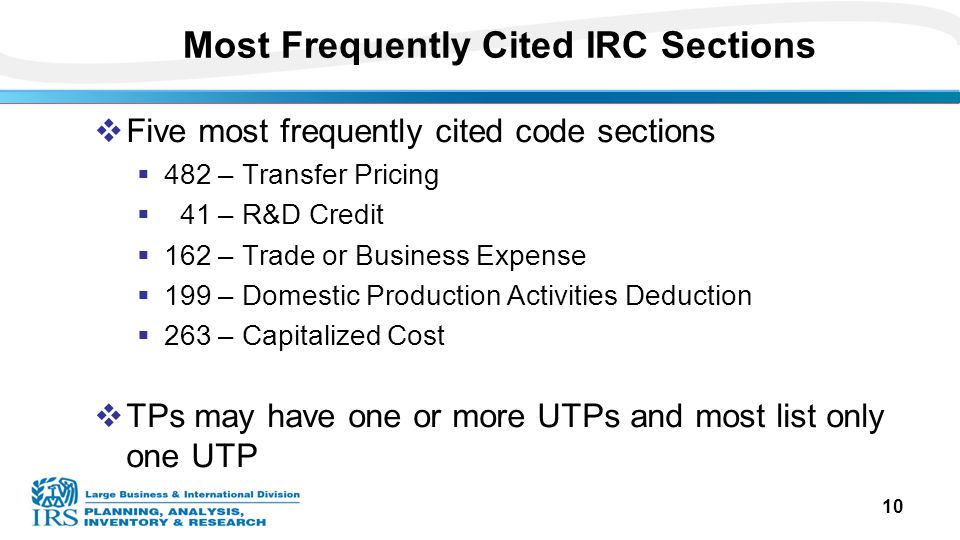

Section 482 places a controlled taxpayer on a tax parity with an uncontrolled taxpayer by determining the true taxable income of the controlled taxpayer.

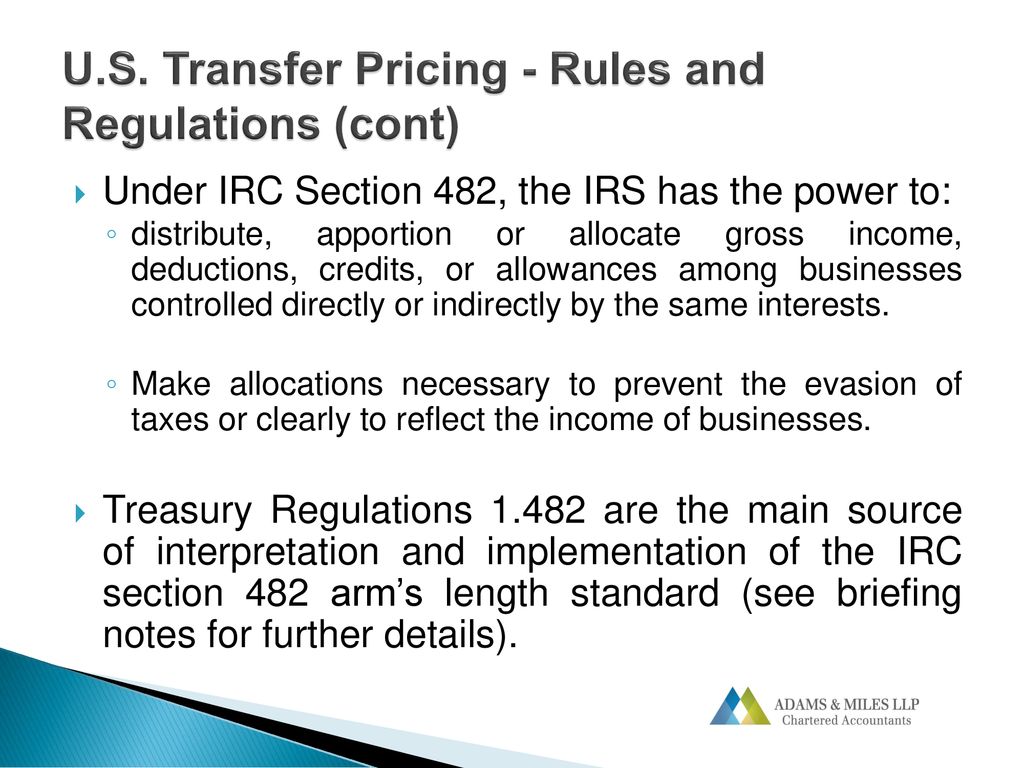

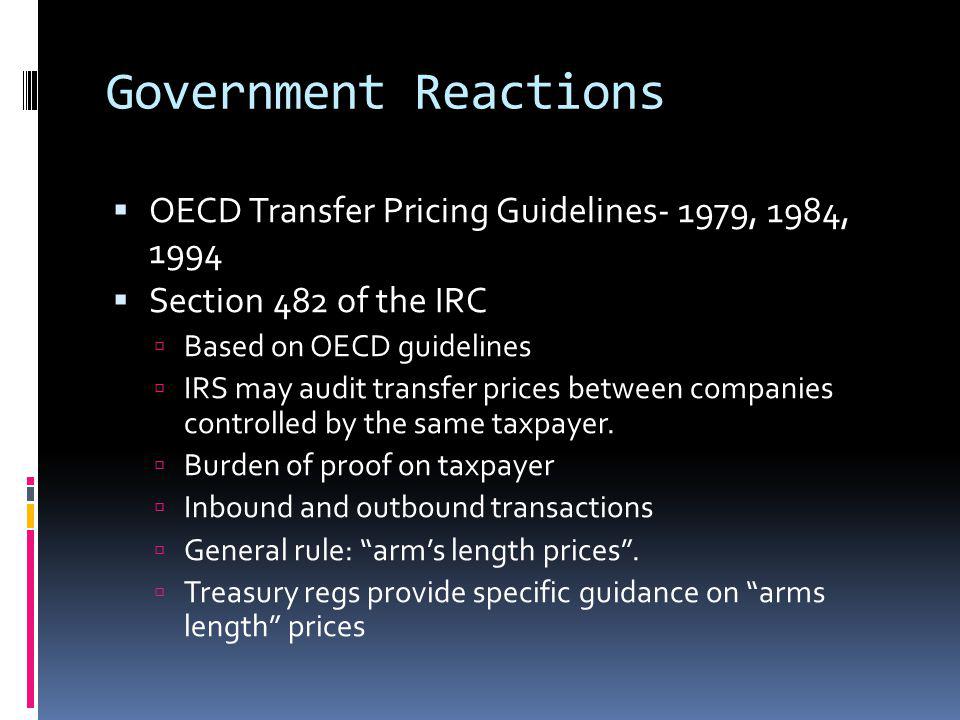

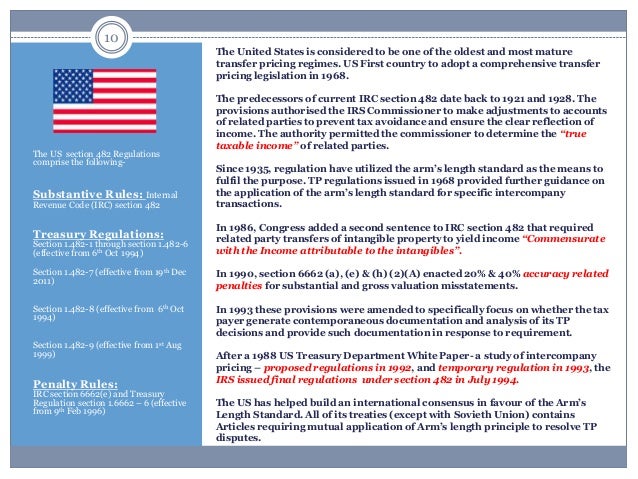

Irc section 482. The transfer pricing rules set forth in the treasury regulations with respect to irc sec. Allocation of income and deductions among taxpayers authorizes the irs commissioner allocation of income and deductions between related entities for comparing tax obligations. 1 1992 submit to committee on ways and means of house of representatives and committee on finance of senate a report on the study together with such recommendations as he deemed advisable.

The purpose of irc 482 is to ensure taxpayers clearly reflect income attributable to controlled transactions and to prevent avoidance of taxes regarding such transactions. 482 the section 482 regulations have remained relatively unchanged since 1986. 1388 458 directed secretary of the treasury or his delegate to conduct a study of the application and administration of section 482 of the internal revenue code of 1986 and not later than mar.

The purpose of section 482 is to ensure that taxpayers clearly reflect income attributable to controlled transactions and to prevent the avoidance of taxes with respect to such transactions. The study shall include a review of the contemporaneous documentation and penalty rules under section 6662 of the internal revenue code of 1986 a review of the regulatory and administrative guidance implementing the principles of section 482 of such code to transactions involving intangible property and services and to cost sharing arrangements and an examination of whether increased disclosure of cross border transactions should be required. 101 508 title xi 11316 nov.

5 1990 104 stat. Irc section 482 compares a controlled taxpayer with an uncontrolled taxpayer according to arm s length pricing to determine tax liabilities for the prevention of tax evasion and to reflect accurately the income of such entities.