Irc Section 301

Internal revenue code 301.

Irc section 301. Because corporation x is an affected. Without application of this section corporation x has 90 days or until october 26 2009 to file a petition with the tax court. Q title iii 301 b dec.

E g form 1040 form 1040nr form 1040a or form 1040ez under section 301 7216 3 of the regulations on procedure and administration 26 cfr part 301. 91 172 title v 506 c dec. 30 1969 83 stat.

301 b 1 general rule. 31 1969 see section 301 c of pub. However pursuant to paragraph c of this section filing a petition with the tax court is one of the taxpayer acts for which a period of up to one year may be disregarded.

301 a in general except as otherwise provided in this chapter a distribution of property as defined in section 317 a made by a corporation to a shareholder with respect to its stock shall be treated in the manner provided in subsection c. Such distributions except as otherwise. The international code council icc is a non profit organization dedicated to developing model codes and standards used in the design build and compliance process.

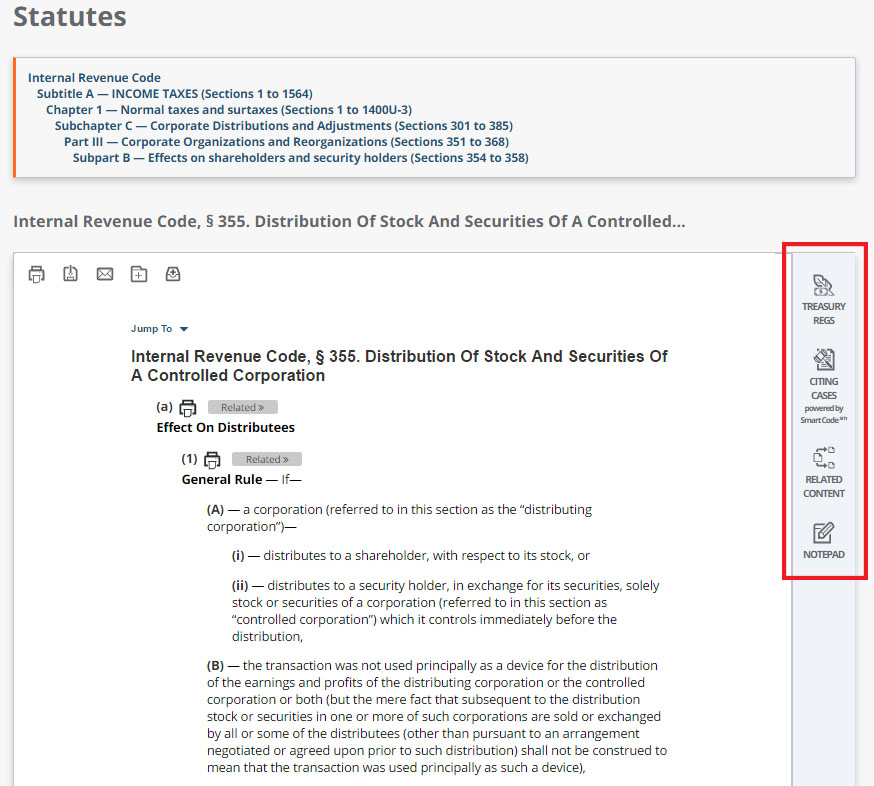

Section 301 provides the general rule for treatment of distributions on or after june 22 1954 of property by a corporation to a shareholder with respect to its stock. 91 172 applicable to taxable years ending after dec. Amendment by section 301 b 9 of pub.

91 172 set out as a note under section 5 of this title. In the case of any organization described in paragraph 3 or 4 of section 501 c of the internal revenue code of 1986 and with respect to which the provision of credit counseling services is a substantial purpose on the date of the enactment of this act. 301 b amount distributed i r c.