Internal Revenue Code Section 403 A

Annual reporting is required.

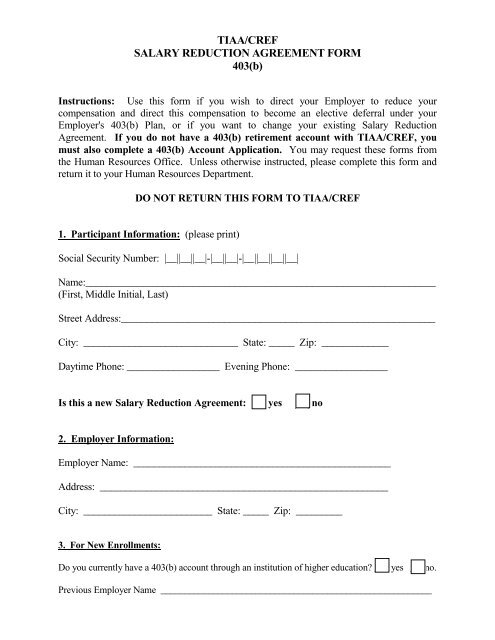

Internal revenue code section 403 a. As these descriptions suggest those annuities provide a method for deferring the receipt and taxation of income which would otherwise be currently taxable as. For purposes of this section and sections 402 403 and 404 the term annuity includes a face amount certificate as defined in section 2 a 15 of the investment company act of 1940 15 u s c sec. Except in the case of a rollover contribution described in subsection d 3 or in section 402 c 403 a 4 403 b 8 or 457 e 16 no contribution will be accepted unless it is in cash and contributions will not be accepted for the taxable year on behalf of any individual in excess of the amount in effect for such taxable year under section 219 b 1 a.

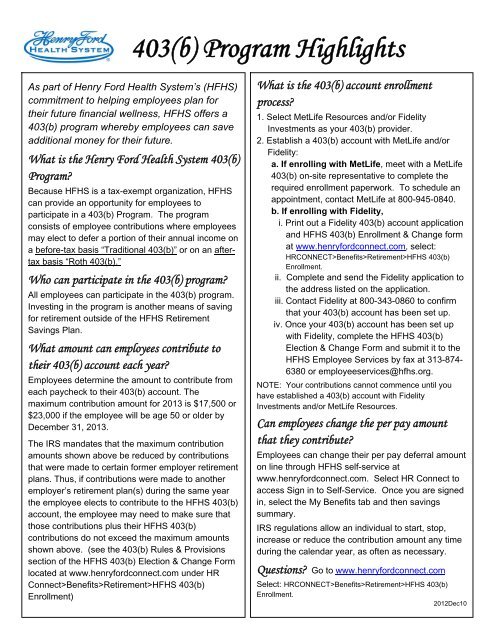

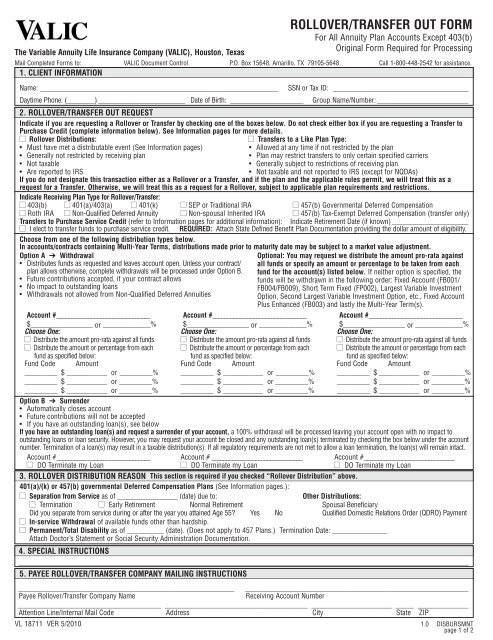

1 the contribution is made by reason of a mistake of fact. In the case of a distribution of property other than money the amount so transferred consists of the property distributed then such distribution to the extent so transferred shall not be includible in gross income for the taxable year in which paid. A 403 b plan also called a tax sheltered annuity or tsa plan is a retirement plan offered by public schools and certain 501 c 3 tax exempt organizations.

Employees save for retirement by contributing to individual accounts. A 403 a plan is a qualified plan funded by a group annuity contract instead of a trust. 104 188 set out below to the extent that such distribution is not includible in income by reason of.

Section 403 c 2 of erisa for which there is no parallel provision in the internal revenue code generally provided prior to its amendment by obra 87 that the general prohibi tion against diversion does not pre clude the return of a contribution made by an employer to a plan if. See irc 404 a 2. If an annuity contract is purchased by an employer for an employee under a plan which meets the requirements of section 404 a 2 whether or not the employer deducts the amounts paid for the contract under such section the amount actually distributed to any distributee under the contract shall be taxable to the distributee in the year in which so distributed under section 72 relating to annuities.

Section 403 b of the internal revenue code1 authorizes what are commonly described as tax sheltered annuities or tax deferred annuities for certain classes of public employees. A paragraphs 7 a ii and 11 of section 403 b of the internal revenue code of 1986 shall not apply with respect to a distribution from a contract described in section 1450 b 1 of such act pub. Before enactment of this section it was possible for an employee of certain tax exempt organizations to defer income through the use of a tax sheltered annuity arrangement.

But does not include any contract or certificate issued after december 31 1962 which is transferable if any person other than the trustee of a trust described in section 401 a which is exempt from tax under section 501 a is the owner of such contract or certificate. Irc 403 b was enacted as a restriction on the. 403 a 4 a iii.