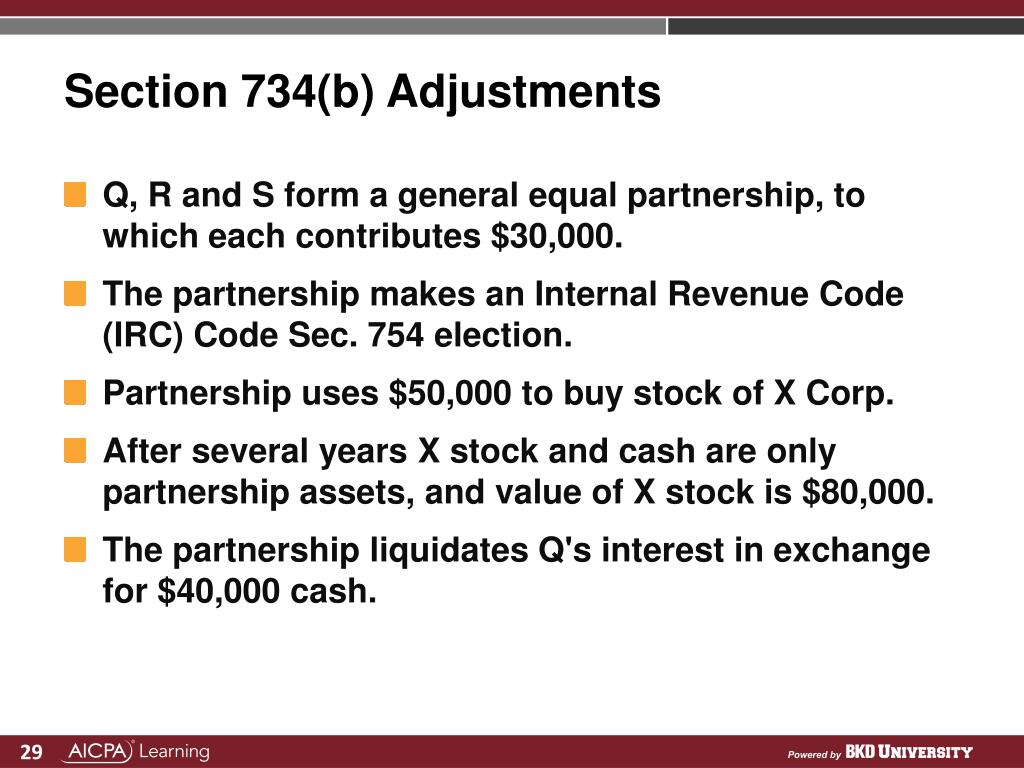

Code Section 754 Election

1 an election under section 754 and this section to adjust the basis of partnership property under sections 734 b and 743 b with respect to a distribution of property to a partner or a transfer of an interest in a partnership shall be made in a written statement filed with the partnership return for the taxable year during which the distribution or transfer occurs.

Code section 754 election. The purpose of a section 754 election is to reconcile a new partner s outside and inside basis in the partnership. Section 754 election 1065 only under section 754 a partnership may elect to adjust the basis of partnership property when property is distributed or when a partnership interest is transferred. Such an election shall apply with respect to all distributions of property by the partnership and to all transfers of interests in the partnership during the taxable year with respect to which such election was filed and all subsequent taxable years.

743 b 1. The company shall make the election provided for under code section 754 for the first fiscal year during which there is an exchange pursuant to section 9 1 or earlier if determined to be in the best interest of the company and its members by rhi inc. Distribution of partnership property or transfer of an interest by a partner.

Section 754 allows a partnership to make an election to step up the basis of the assets within a partnership when one of two events occurs. In the case of a transfer of an interest in a partnership by sale or exchange or upon the death of a partner a partnership with respect to which the election provided in section 754 is in effect or which has a substantial built in loss immediately after such transfer shall i r c. And such election shall not be revoked.

A section 754 election can be a favorable tax efficiency tool that is unique to partnerships as compared to corporations.