California Labor Code Section 226

A it is unlawful for any person or employer to engage in any of the following activities.

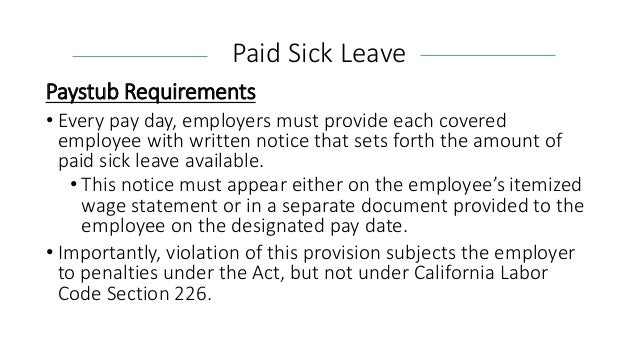

California labor code section 226. A as used in this section recovery period means a cooldown period afforded an employee to prevent heat illness. A an employer semimonthly or at the time of each payment of wages shall furnish to his or her employee either as a detachable part of the check draft or voucher paying the employee s wages or separately if wages are paid by personal check or cash an accurate itemized statement in writing showing 1 gross wages earned 2 total hours worked by the employee except as provided in subdivision j 3 the number of piece rate units earned and any applicable piece rate if the employee. 1 willful misclassification of an individual as an independent contractor.

Every employer shall semimonthly or at the time of each payment of wages furnish each of his or her employees either as a detachable part of the check draft or voucher paying the employee s wages or separately when wages are paid by personal check or cash an accurate itemized statement in writing showing 1 gross wages earned 2 total hours worked by the employee except for any employee whose compensation is solely based on a salary and who is exempt from payment of overtime. Labor code 226 failure to adhere to all of labor code check those paga notice letters. A an employer semimonthly or at the time of each payment of wages shall furnish to his or her employee either as a detachable part of the check draft or voucher paying the employee s wages or separately if wages are paid by personal check or cash an accurate itemized statement in writing showing 1 gross wages earned 2 total hours worked by the employee except as provided in subdivision j 3 the number of piece rate units earned and any.

A an employer semimonthly or at the time of each payment of wages shall furnish to his or her employee either as a detachable part of the check draft or voucher paying the employee s wages or separately if wages are paid by personal check or cash an accurate itemized statement in writing showing 1 gross wages earned 2 total hours worked by the employee except as provided in subdivision j 3 the number of piece rate units earned and any applicable piece rate if the. California labor code section 226. B an employer shall not require an employee to work during a meal or rest or recovery period mandated pursuant to an applicable statute or applicable regulation standard or order of the industrial welfare commission the occupational safety and health standards board or the division of occupational safety and health.

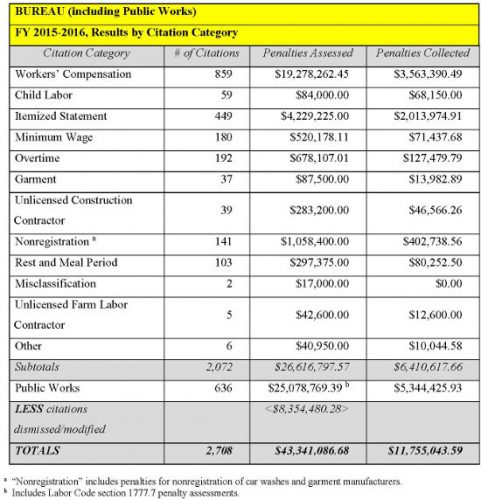

Any employer who violates subdivision a of section 226 shall be subject to a civil penalty in the amount of two hundred fifty dollars 250 per employee per violation in an initial citation and one thousand dollars 1 000 per employee for each violation in a subsequent citation for which the employer fails to provide the employee a wage deduction statement or fails to keep the records required in subdivision a of section 226.